Many Indian startups have become “unicorns” in recent years. Unicorn startups are private companies worth over $1 billion. These startups innovate and create new markets in India. India is attracting unicorn startups in e-commerce, fintech, edtech, healthtech, and more due to its large pool of talented and ambitious entrepreneurs. In this post, We’ll talk about the Unicorn Startups in India, as per reported by CB Insights.

“Witness the meteoric rise of the Fastest Growing Unicorn, reshaping India’s entrepreneurial landscape.”

Latest unicorn startups in India

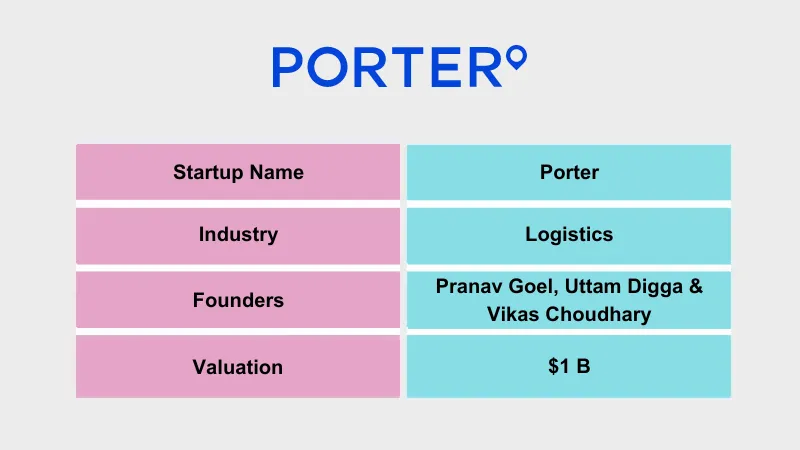

Porter is the latest unicorn of the year. After B2B SaaS startup Perfios and AI startup Krutrim, Porter is the third unicorn of the year 2024 (May). logistics-based startup Porter turns unicorn, closes internal round at $1 billion valuation.

Most popular unicorn startups in India

Dream11, Zomato, BYJU’s, Swiggy, OyO, and PhysicsWallah are some of the popular unicorn startups in India.

First Unicorn in 2024

Krutrim which was founded by Ola founder Bhavish Aggarwal is the first unicorn in 2024.

2nd Unicorn in 2024

Perfios is a 2nd Unicorn in 2024, after securing $80 Mn in funding from multiple initiatives such as Teachers’ Venture Growth (TVG) and others.

Top 100 Unicorn Startups in India 2024

Over the past decade, India’s startup ecosystem has changed. Startups have grown due to government support, venture capital funding, and skilled talent. According to reports, India has 108 unicorns and will likely have more in the future.

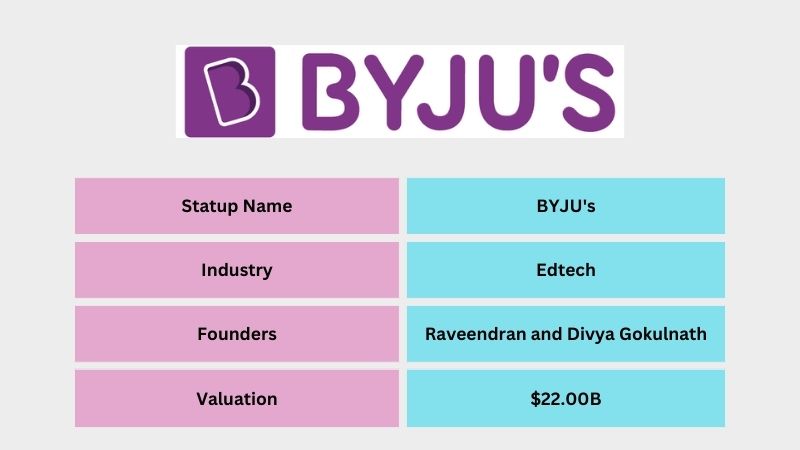

BYJU’s – Popular Unicorn Startups in India

BYJU’s is an Indian Edtech company founded by Raveendran and Divya Gokulnath. The company’s online learning platform for students from kindergarten to competitive exam training. Within five years of its launch, BYJU became a unicorn with a valuation of $1.1 billion on July 25, 2017.

Empower the future of education with a glimpse into the transformative Edtech Startup in India.

Today, the company is valued at $22 billion, making it one of India’s most valuable Edtech companies. BYJU’s investors include Tencent Holdings, Lightspeed India Partners, Sequoia Capital India.

Swiggy – Best Unicorn Startup in India

Swiggy, a Bengaluru-based startup that specializes in supply chain, logistics, and delivery services, achieved unicorn on 21 June 2018. The current valuation of the company is $10.70B.

“Join the celebration as Indian startups join the prestigious Indian Startup into Foodtech Club, marking milestones of success.”

The Company was founded by Sriharsha Majety Nandan Reddy Rahul Jaimini. The Company has received funding from investors including Accel India, SAIF Partners, and Norwest Venture Partners.

OYO Rooms – Top Unicorn Startups in India

OYO Rooms is an Indian travel company founded by Ritesh Agarwal. The company provides hotel rooms at affordable rates. Within five years of its launch, OYO became a unicorn with a valuation of $5 billion on September 25, 2018.

Optimize your business travel experience with Top Business Travel and Expense Management.

Today, the company is valued at $9.00 billion, making it one of the most valuable travel companies in India. Oyo’s investors include SoftBank Group, Sequoia Capital India, Lightspeed India Partners.

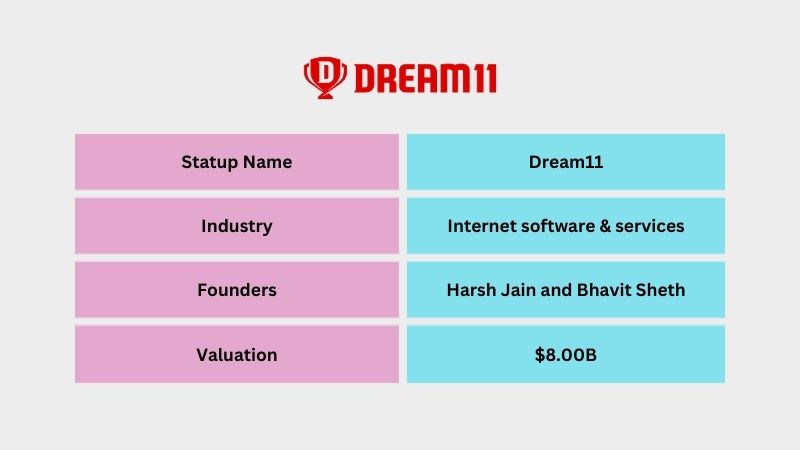

DREAM 11 – Popular Unicorn Startups in India

DREAM 11 is an Indian fantasy Sports platform founded by Harsh Jain and Bhavit Sheth. Dream11 is an online game that allows users to create a virtual team of real-life players, and score points based on their performance in actual matches. The user with the highest score in their respective contests tops the leaderboard. Dream11 achieved unicorn status in April 2019, making it the first Indian fantasy sports company to reach this milestone.

Today, the company is valued at $8.00 billion, making it one of the most Fantasy sports companies in India. DREAM 11 investors include Kaalari Capital, Tencent Holdings, and Steadview Capital.

Witness the convergence of innovation and technology with India’s Best Tech Startups in India leading the charge.

Ola Cabs – Elite Unicorn Startups in India

Ola Cabs is an Indian Auto & transportation company founded by Bhavish Aggarwal and Ankit Bhati. The company provides cabs at affordable rates. Within four years of its launch, Ola Cabs became a unicorn on September 27, 2014.

Optimize your fleet with innovative Fleet Management Startups in India driving efficiency and sustainability.

Today, the company is valued at $7.50 billion, making it one of the most valuable Auto & transportation companies in India. Ola’s investors include Accel Partners, SoftBank Group, and Sequoia Capital.

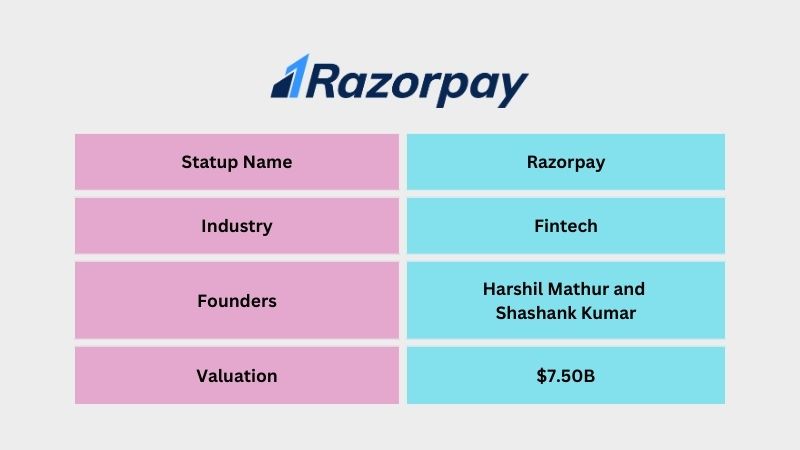

Razorpay – Top Unicorn Startups in India

Razorpay is an Indian Fintech company founded by Harshil Mathur and Shashank Kumar. The company provides Payment Gateways. Within Seven years of its launch, Razorpay became a unicorn with a valuation of $1 billion on September 11, 2020.

Know about the Top Fintech Investors fueling the growth of innovative startups in India’s healthcare sector.

Today, the company is valued at $7.50 billion, making it one of the most valuable travel companies in India. Razorpay’s investors include Sequoia Capital India, Tiger Global Management, and Matrix Partners India.

CRED – Popular Unicorn Startups in India

CRED is an Indian Fintech company founded by Kunal Shah. CRED is a private community that incentivizes people to make timely payments on their credit card bills by giving them exclusive benefits and opportunities. The platform offers a centralized hub where individuals can oversee multiple credit cards and track their credit scores. Within Three years of its launch, CRED became a unicorn with a valuation of $2.2 billion on June 4, 2020.

Unlock the potential of financial technology with a closer look at Fintech Startups reshaping India’s economy.

Read also – Top 10 Best Coworking Startups in India

Today, the company is valued at $6.40 billion, making it one of the most valuable Fintech companies in India. CRED investors include Tiger Global Management, DST Global, and Sequoia Capital India.

OfBusiness – Top Unicorn Startups in India

OfBusiness is an E-commerce & direct-to-consumer company founded by Asish Mohapatra, Ruchi Kalra, Bhuvan Gupta, Vasant Sridhar, and Nitin Jain. The organization offers loans to small and medium-sized enterprises (SMEs), providing them with unsecured credit up to Rs 2 crore through NBFC – Oxyzo Financial Services. Within Six years of its launch, OfBusiness became a unicorn with a valuation of $1.5 billion on July 31, 2021.

Experience the evolution of India’s trailblazing Ecommerce Unicorn at the helm.

Today, the company is valued at $5.00 billion, making it one of the most valuable E-commerce & direct-to-consumer companies in India. OfBusiness investors include Matrix Partners India, Falcon Edge Capital, and SoftBank Group.

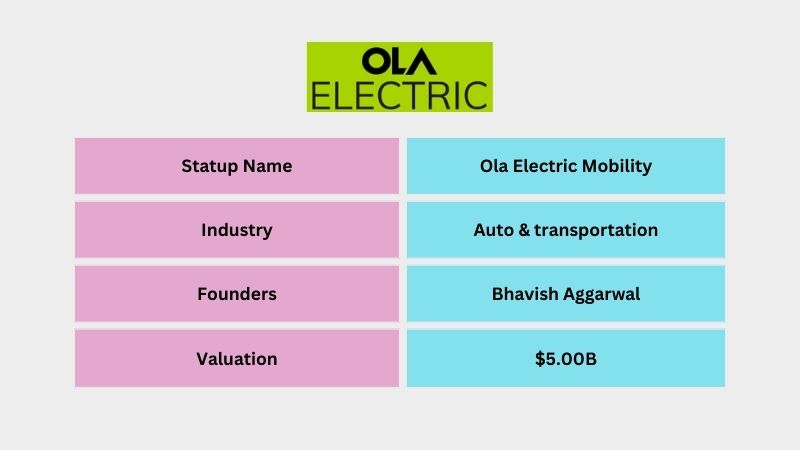

Ola Electric Mobility – Best Unicorn Startups in India

Ola Electric Mobility is an Indian Auto & transportation company founded by Bhavish Aggarwal. The company provides the best electric Ola Scooters. Within Two years of its launch, Ola Electric Mobility became a unicorn with a valuation of $1 billion on July 2, 2019.

Witness the convergence of innovation and technology with India’s Best Tech Startups in India leading the charge.

Today, the company is valued at $5.00 billion, making it one of the most valuable Auto & transportation companies in India. Ola’s investors include SoftBank Group, Tiger Global Management, and Matrix Partners India.

Pine Labs – Elite Unicorn Startups in India

Pine Labs is an Indian Fintech company founded by Lokvir Kapoor, Rajul Garg, and Tarun Upadhyay. The company provides a comprehensive merchant platform that combines technology and financial solutions. After a long time since its launch, Pine Labs became a unicorn with a valuation of $1.6 billion on January 24, 2020.

Today, the company is valued at $5.00 billion, making it one of the most valuable Fintech companies in India. Pine Labs investors include Sequoia Capital India, Temasek, and PayPal Ventures.

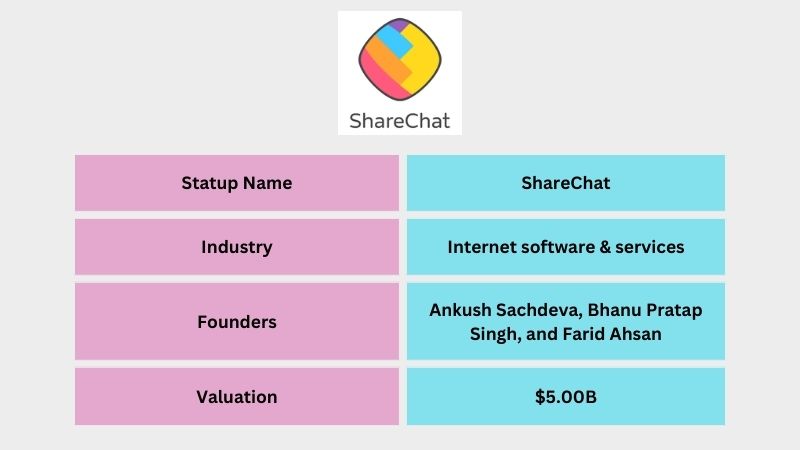

ShareChat is an Indian Internet software & services company founded by Ankush Sachdeva, Bhanu Pratap Singh, and Farid Ahsan. ShareChat is a leading social media platform that enables users to express their views, document their daily experiences, and connect with new people in their preferred language. Within Six years of its launch, ShareChat became a unicorn with a valuation of $2.1 billion on April 8, 2021.

Today, the company is valued at $5.00 billion, making it one of the most valuable Software & service companies in India. ShareChat investors include India Quotient, Elevation Capital, and Lightspeed Venture Partners.

Verse Innovation – Popular Unicorn Startups in India

Verse Innovation is an Indian Mobile & telecommunications company founded by Virender Gupta. Verse Innovation is a content technology platform that empowers users to access content in their native language on Dailyhunt. Verse Innovation became a unicorn with a valuation of $1.1 billion on December 22, 2020.

Today, the company is valued at $5.00 billion, making it one of India’s most valuable Mobile & telecommunications companies. Verse Innovation investors include Falcon Edge Capital, Omidyar Network, and Sequoia Capital India.

Meesho

Meesho is an Indian Internet software & services company founded by Vidit Aatrey and Sanjeev Barnwal. Meesho is a social commerce solution that facilitates retail distribution and empowers small-scale merchants to connect with potential customers and market their products efficiently through social media. Within Six years of its launch, Meesho became a unicorn with a valuation of $2.1 billion on April 5, 2021.

Dive into the valuation and impact of India’s Most Valuable Startup, shaping industries and markets.

Today, the company is valued at $4.90 billion, making it one of the most valuable Internet software & services companies in India. Meesho’s investors include Venture Highway, Sequoia Capital India, Prosus Ventures.

Lenskart

Lenskart is an Indian E-commerce & direct-to-consumer company founded by Peyush Bansal, and Amit Chaudhary. The company provides glasses at affordable rates. Within five years of its launch, Lenskart became a unicorn with a valuation of $1.5 billion on December 20, 2019.

Experience the evolution of India’s trailblazing Ecommerce Unicorn at the helm.

Today, the company is valued at $4.50 billion, making it one of the most valuable optical companies in India. Lenskart’s investors include Chiratae Ventures, Premji Invest, & Softbank.

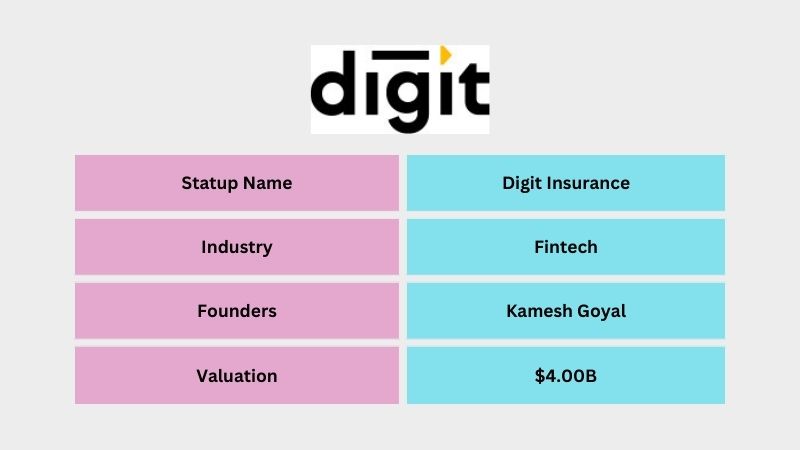

Digit Insurance

Digit Insurance is an Indian Fintech company founded by Kamesh Goyal. The company provides car insurance, travel insurance, home insurance, commercial vehicle insurance, and shop insurance. Within six years of its launch, Digit Insurance became a unicorn with a valuation of $1.9 billion on January 15, 2021.

Unlock the potential of financial technology with a closer look at Fintech Startups reshaping India’s economy.

Today, the company is valued at $4.00 billion, making it one of the most valuable travel companies in India. Digit Insurance’s investors include Fairfax Financial Holdings, A91 Partners, and TVS Capital.

Unacademy

Unacademy is an Indian Edtech company founded by Gaurav Munjal, Roman Saini, and Hemesh Singh. The company provides a personalized online learning platform for students to competitive exams such as UPSC, IIT-JEE, and CAT. Within five years of its launch, Unacademy became a unicorn with a valuation of $1.45 billion on September 2, 2020.

Empower the future of education with a glimpse into the transformative Edtech Startup in India.

Today, the company is valued at $3.4 billion, making it one of the most valuable Edtech companies in India. Unacademy’s investors include Blume Ventures, Nexus Venture Partners, Sequoia Capital India

Upstox

Upstox is an Indian Fintech company founded by Ravi Kumar, Shrini Viswanath, and Kavitha Subramanian. The company offers online investments in Stocks, Derivatives, Commodities, Currencies, Mutual Funds, and ETFs for investors and traders. After twelve years of its launch, Upstox became a unicorn with a valuation of $3 billion on November 29, 2021.

Read also – Top 10 Biotech Startups In India | Best Biotech Companies

Today, the company is valued at $3.40 billion, making it one of the most valuable Fintech companies in India. Upstox’s investors include Tiger Global Management and Kalaari Capital.

Cars24

Cars24 is an Indian E-commerce & direct-to-consumer company founded by Mehul Agrawal, Ruchit Agarwal, and Vikram Chopra. The company is involved in buying and selling used cars. Within five years of its launch, Cars24 became a unicorn with a valuation of $1.8 billion on November 24, 2020.

Witness the convergence of innovation and technology with India’s Best Tech Startups in India leading the charge.

Today, the company is valued at $3.30 billion, making it one of the most valuable E-commerce & direct-to-consumer companies in India. Cars24’s investors include Moore Strategic Ventures, DST Global, and Sequoia Capital India.

Eruditus Executive Education

Eruditus Executive Education is an Indian Edtech company founded by Ritesh Agarwal. The company provides individuals, companies, and governments worldwide with affordable and accessible high-quality education aimed at teaching them future-ready skills. Within five years of its launch, Eruditus Executive Education became a unicorn with a valuation of $3.2 billion on September 25, 2018.

Immerse yourself in the vibrant Startups in Bengaluru known as the silicon valley of India.

Today, the company is valued at $3.20 billion, making it one of the most valuable Edtech companies in India. Eruditus Executive Education’s investors include Sequoia Capital India, Softbank, Bertelsmann India Investments.

Udaan

Udaan is an Indian Supply chain, logistics, & delivery company founded by Amod Malviya, Vaibhav Gupta, Sujeet Kumar, and Adarsh Raidurg. The company offers B2B services to manufacturers, traders, suppliers, and wholesalers in smaller towns. Within 26 months of its launch, Udaan became a unicorn with a valuation of $1 billion on September 4, 2018.

Discover the vibrant ecosystem of Indian Cities with Their Startups where they nurturing.

Today, the company is valued at $3.10 billion, making it one of the most valuable Supply chain, logistics, & delivery companies in India. udaan’s investors include DST Global, Lightspeed Venture Partners, Microsoft ScaleUp.

Groww

Groww is an Indian Fintech company founded by Lalit Kishore. The company provides a trading platform where investors allow to invest in stocks and mutual funds. Within five years of its launch, Groww became a unicorn with a valuation of $1 billion on April 7, 2021.

Delve into the challenges and strategies of Loss Making Unicorns striving to turn the tide in their favor.

Today, the company is valued at $3.00 billion, making it one of the most valuable Fintech companies in India. Groww’s investors include Tiger Global Management, Sequoia Capital India, Ribbit Capital.

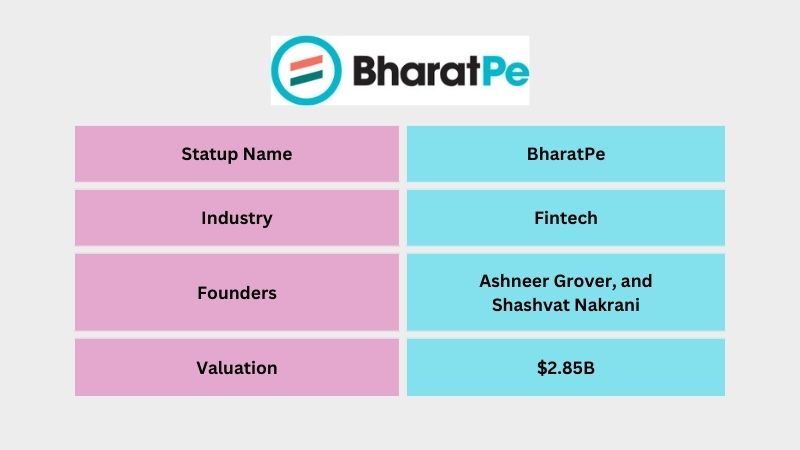

BharatPe

BharatPe is an Indian Fintech company founded by Ashneer Grover, and Shashvat Nakrani. The company provides QR codes for merchants to accept UPI payments. Within three years of its launch, BharatPe became a unicorn with a valuation of $2.85 billion on July 30, 2020.

Today, the company is valued at $2.85 billion, making it one of the most valuable Fintech companies in India. Fintech’s investors include Insight Partners, Sequoia Capital India, BEENEXT.

Zetwerk

Zetwerk is an Indian Internet software & services company founded by Amrit Acharya. The company has global end-to-end manufacturing supply-chain solutions. Within five years of its launch, Zetwerk became a unicorn with a valuation of $1.33 billion on August 20, 2021.

Explore the success stories of Profitable Unicorn Startups in India flourishing in India’s dynamic market.

Today, the company is valued at $2.68 billion, making it one of the most valuable travel companies in India. Zetwerk’s investors include Sequoia Capital India, Kae Capital, Accel.

Games24x7

Games24x7 is an Indian Internet software & services company founded by Bhavin Pandey. The company provides online gaming where users can earn real money ( Rummy Circle and My11Circle). Games24x7 became a unicorn with a valuation of $2.5 billion on March 30, 2022.

Illuminate the future with Profitable Solar Business ventures paving the way for sustainable growth.

Today, the company is valued at $2.50 billion, making it one of the most valuable Internet software & services companies in India. Games24x7’s investors include Tiger Global Management, The Raine Group, Malabar Investments.

Infra.Market

Infra. market is an Indian travel company founded by Aaditya Sharda and Souvik Sengupta. The company provides one-step solutions for all construction materials. Within five years of its launch, Infra. The market became a unicorn with a valuation of $1 billion on February 25, 2021.

Today, the company is valued at $2.50 billion, making it one of the most valuable travel companies in India. Infra.Market’s investors include Accel, Tiger Global Management, Nexus Venture Partners.

Mobile Premier League (MPL)

Mobile Premier League is an Indian Internet software & services company founded by Sai Srinivas Kiran G. The company provides eSports and mobile gaming. Within three years of its launch, Mobile Premier League became a unicorn with a valuation of $2.3 billion on September 25, 2021.

Embark on a journey of technological advancement with pioneering IT Startups reshaping India’s digital landscape.

Today, the company is valued at $2.45 billion, making it one of the most valuable Internet software & services companies in India. Mobile Premier League’s investors include Sequoia Capital India, RTP Global, and Go-Ventures.

PolicyBazaar

PolicyBazaar is an Indian Fintech company founded by Yashish Dahiya, Alok Bansal, and Avaneesh Nirjar. The company provides several types of insurance plans such as health insurance, and travel insurance. Within five years of its launch, PolicyBazaar became a unicorn with a valuation of $1 billion on May 19, 2019.

Unlock the potential of financial technology with a closer look at Fintech Startups reshaping India’s economy.

Today, the company is valued at $2.40 billion, making it one of the most valuable Fintech companies in India. PolicyBazaar’s investors include Info Edge, Softbank Capital.

upGrad

upGrad is an Indian Edtech company founded by Ronnie Screwvala, Mayank Kumar, Phalgun Kompalli, and Ravijot Chugh. The company provides online certification courses such as digital marketing and data science. Within six years of its launch, UpGrad became a unicorn with a valuation of $1.2 billion on August 9, 2021.

Today, the company is valued at $2.25 billion, making it one of India’s most valuable travel companies. UpGrad’s investors include Qualcomm Ventures, Accel, Canaan Partners.

CoinDCX

CoinDCX is an Indian Fintech company founded by Sumit Gupta, and Neeraj Khandelwal. The company provides a platform where anyone can buy, sell, and trade cryptocurrencies. Within three years of its launch, CoinDCX became a unicorn with a valuation of $1.1 billion on August 10, 2021.

Join the celebration as Indian startups join the prestigious Indian Startup into Unicorn Club, marking milestones of success.

Today, the company is valued at $2.15 billion, making it one of the most valuable Fintech companies in India. CoinDCX’s investors include Polychain Capital, Coinbase Ventures, Jump Capital.

FirstCry

FirstCry is an ecommerce company founded by Supam Maheshwari Amitava Saha Prashant Jadhav Sanket Hattimattur. The company provides products for babies and moms. FirstCry became a unicorn with a valuation of $1 billion on February 7, 2020.

Today, the company is valued at $2.15 billion, making it one of the most valuable ecommerce companies in India. firstcry’s investors include Polychain Capital, Coinbase Ventures, Jump Capital.

Urban Company

Urban Company is an Indian E-commerce & direct-to-consumer company founded by Abhiraj Bhal, Varun Khaitan, and Raghav Chandra. The company provides a one-stop-shop for users to hire high-quality service professionals, ranging from beauty therapists, masseuses, and technicians, to carpenters and sofa cleaners. After seven years of its launch, Urban Company became a unicorn with a valuation of $2 billion on April 27, 2021.

Today, the company is valued at $2.10 billion, making it one of the most valuable E-commerce & direct-to-consumer companies in India. Urban Company’s investors include VY Capital, Accel, and Elevation Capital.

CoinSwitch Kuber

CoinSwitch Kuber is an Indian Fintech company founded by Ashish Singhal. The company provides a trading platform for Bitcoin and cryptocurrencies. Within four years of its launch, CoinSwitch Kuber became a unicorn with a valuation of $5 billion on September 6, 2021.

Today, the company is valued at $1.90 billion, making it one of the most valuable Fintech companies in India. CoinSwitch Kuber’s investors include Tiger Global Management, Sequoia Capital India, Ribbit Capital.

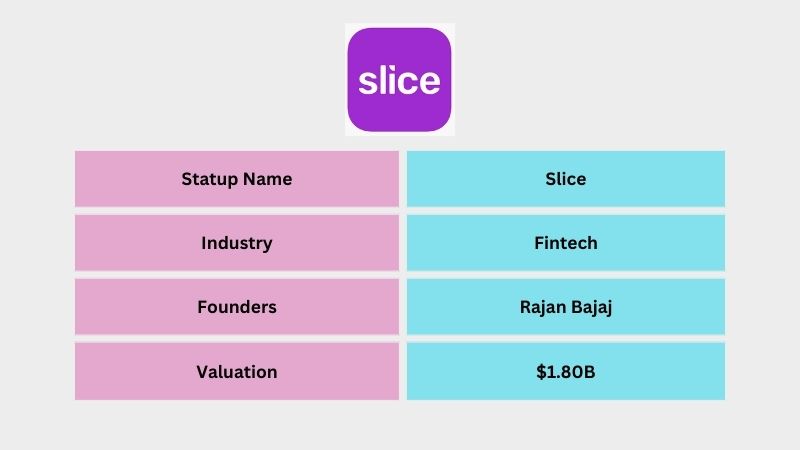

Slice

Slice is an Indian travel company founded by Rajan Bajaj. The company offers credit cards. Within five years of its launch, Slice became a unicorn with a valuation of $1 billion on November 11, 2021.

Explore Best Alternative to Startups with innovative models shaping the entrepreneurial landscape.

Today, the company is valued at $1.80 billion, making it one of the most valuable travel companies in India. Slice’s investors include Gunosy Capital, Blume Ventures, Das Capital.

Spinny

Spinny is an Indian travel company founded by Niraj Singh, Mohit Gupta and Ramanshu Mahau. The company provides used cars. Within six years of its launch, Spinny became a unicorn with a valuation of $1.8 billion on November 24, 2021.

Today, the company is valued at $1.75 billion, making it one of the most valuable travel companies in India. Spinny’s investors include General Catalyst, Elevation Capital, and Avenir Growth Capital.

DealShare is an Indian E-commerce & direct-to-consumer company founded by Vineet Rao. The company provides an online buying platform for multi-category consumer products. Within four years of its launch, DealShare became a unicorn with a valuation of $5 billion on January 1, 2022.

Today, the company is valued at $1.70 billion, making it one of the most valuable E-commerce & direct-to-consumer companies in India. E-commerce & direct-to-consumer investors include Alpha Wave Global, Matrix Partners India, and Tiger Global Management.

CureFit

CureFit is an Indian Health company founded by Mukesh Bansal. The company provides digital and offline experiences across fitness, nutrition, and mental well-being. Within five years of its launch, CureFit became a unicorn with a valuation of $1.5 billion on November 11, 2021.

Today, the company is valued at $1.50 billion, making it one of the most valuable Health companies in India. CureFit’s investors include Chiratae Ventures, Accel, Kalaari Capital.

ElasticRun

ElasticRun is an Indian Supply chain, logistics, & delivery company founded by Sandeep Deshmukh, Shitiz Bansal, and Saurabh Nigam. The company provides app-driven, logistics and distribution company. After seven years of its launch, ElasticRun became a unicorn with a valuation of $1.5 billion on February 7, 2022.

Today, the company is valued at $1.50 billion, making it one of the most valuable Supply chain, logistics, & delivery companies in India. ElasticRun’s investors include Kalaari Capital, Norwest Venture Partners, and Prosus Ventures.

Amagi

Amagi is an Indian Internet software & services company founded by Baskar Subramanian. The company provides end-to-end cloud-managed live and on-demand video infrastructure to content owners. Within five years of its launch, Amagi became a unicorn with a valuation of $1 billion on March 16, 2022.

Today, the company is valued at $1.40 billion, making it one of the most valuable Internet software & services companies in India. Amagi’s investors include Mayfield, Accel, Norwest Venture Partners.

boAT

The boAT is an Indian Consumer & retail company founded by Aman Gupta. The company provides earphones, earbuds, headphones, smartwatches, and home audio. Within six years of its launch, boAT became a unicorn with a valuation of $1.4 billion on September 25, 2018.

Today, the company is valued at $1.40 billion, making it one of the most valuable travel companies in India. boAT’s investors include Qualcomm Ventures, Fireside Ventures.

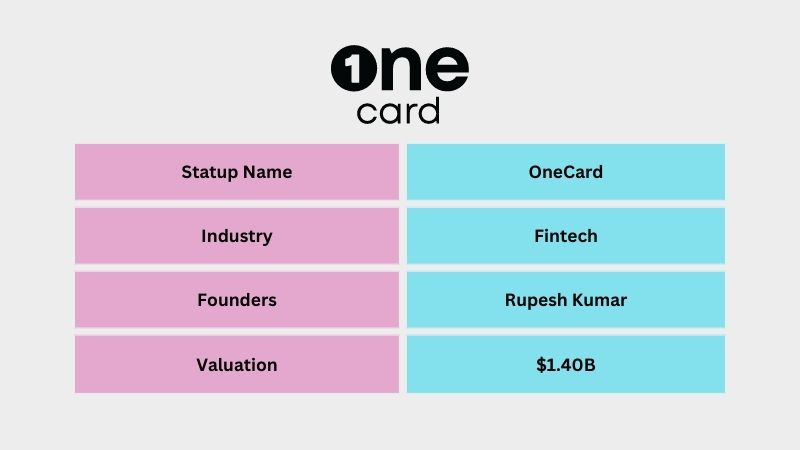

OneCard

OneCard is an Indian Fintech company founded by Rupesh Kumar. The company offers credit cards. Within five years of its launch, OneCard became a unicorn with a valuation of $1.3 billion on July 13, 2022.

Today, the company is valued at $1.40 billion, making it one of the most valuable Fintech companies in India. OneCard’s investors include Sequoia Capital India, Hummingbird Ventures, Matrix Partners India.

Pristyn Care

Pristyn Care is an Indian Health company founded by Dr. Vaibhav Kapoor, Dr. Garima Sawhney, and Harsimarbir Singh. The company provides medical help at affordable prices. Within three years of its launch, Pristyn Care became a unicorn with a valuation of $1.4 billion on December 7, 2021.

Today, the company is valued at $1.40 billion, making it one of the most valuable Health companies in India. Pristyn Care’s investors include Sequoia Capital India, Hummingbird Ventures, Epiq Capital.

Rebel Foods

Rebel Foods is an Indian E-commerce & direct-to-consumer company founded by Jaydeep Barman, and Kallol Banerjee. The company provides online as well as physical food. After ten years of its launch, Rebel Foods became a unicorn with a valuation of $1.4 billion on September 25, 2018.

Today, the company is valued at $1.40 billion, making it one of the most valuable travel companies in India. Rebel Foods’s investors include Sequoia Capital India, Lightbox Ventures, Coatue Management.

Shiprocket

Shiprocket is an Indian Supply chain, logistics, & delivery company founded by Saahil Goel. The company provides cost-effective shipping for direct-to-consumer retailers. After eleven years of its launch, Shiprocket became a unicorn with a valuation of $1.3 billion on August 16, 2022.

Today, the company is valued at $1.30 billion, making it one of the most valuable E-commerce & direct-to-consumer companies in India. Shiprocket’s investors include Bertelsmann India Investments, March Capital Partners, Tribe Capital, Nirvana Venture Advisors.

Yubi

Yubi is an Indian Fintech company founded by Gaurav Kumar. The company helps businesses to secure debt from lenders. Within two years of its launch, Yubi became a unicorn with a valuation of $1.3 billion on March 7, 2022.

Today, the company is valued at $1.30 billion, making it one of the most valuable Fintech companies in India. Yubi’s investors include Insight Partners, B Capital Group, Lightspeed Venture Partners.

CarDekho

CarDekho is an Indian E-commerce & direct-to-consumer company founded by Amit Jain. The company helps buyers choose the right car for them. Within five years of its launch, CarDekho became a unicorn with a valuation of $5 billion on September 25, 2018.

Today, the company is valued at $1.20 billion, making it one of the most valuable E-commerce & direct-to-consumer companies in India. CarDekho’s investors include Sequoia Capital India, Hillhouse Capital Management, Sunley House Capital Management.

LivSpace

LivSpace is an Indian E-commerce & direct-to-consumer company founded by Ramakant Sharma, and Anuj Srivastava. The company provides civil work, custom furniture, false ceiling, flooring, tiling, cladding and so much more. Within eight years of its launch, LivSpace became a unicorn with a valuation of $1.2 billion on February 8, 2022.

Today, the company is valued at $1.20 billion, making it one of the most valuable E-commerce & direct-to-consumer companies in India. LivSpace’s investors include Jungle Ventures, Helion Venture Partners, INGKA Investments.

MyGlamm

MyGlamm is an Indian E-commerce & direct-to-consumer company founded by Darpan Sanghvi. The company provides online makeup products. Within six years of its launch, MyGlamm became a unicorn with a valuation of $1.20 billion on November 10, 2021.

Today, the company is valued at $1.20 billion, making it one of the most valuable E-commerce & direct-to-consumer companies in India. MyGlamm’s investors include L’Occitane, Trifecta Capital, Bessemer Venture Partners.

Xpressbees

Xpressbees is an Indian Supply chain, logistics, & delivery company founded by Amitava Saha. The company provides courier services. Within seven years of its launch, Xpressbees became a unicorn with a valuation of $1.2 billion on February 9, 2022.

Today, the company is valued at $1.20 billion, making it one of the most valuable Supply chain, logistics, & delivery companies in India. Xpressbees’s investors include Norwest Venture Partners, Investcorp, and Blackstone.

Acko General Insurance

Acko General Insurance is an Indian Fintech company founded by Varun Dua. The company provides car/bike as well as health Insurance. Within five years of its launch, Acko General Insurance became a unicorn with a valuation of $1.1 billion on October 28, 2021.

Today, the company is valued at $1.10 billion, making it one of the most valuable Fintech companies in India. Acko General Insurance’s investors include Intact Ventures, Munich Re Ventures, General Atlantic.

Apna

Apna is an Indian Internet software & services company founded by Nirmit Parikh. The company provides Job opportunities to job seekers. Within two years of its launch, Apna became a unicorn with a valuation of $5 billion on September 15, 2021.

Today, the company is valued at $1.10 billion, making it one of the most valuable Internet software & services companies in India. Apna’s investors include Sequoia Capital India and Rocketship.vc, Lightspeed India Partners.

GlobalBees

GlobalBees is an Indian E-commerce & direct-to-consumer company founded by Deepak Khetan and Daman Soni. The company acquires or partners with digitally local brands across a multitude of categories. Within six months of its launch, GlobalBees became a unicorn with a valuation of $1.1 billion on December 28, 2021.

Today, the company is valued at $1.10 billion, making it one of the most valuable E-commerce & direct-to-consumer companies in India. GlobalBees’s investors include Chiratae Ventures, SoftBank Group, Trifecta Capital.

LEAD School

LEAD School is an Indian Edtech company founded by Smita Deorah. The company provides affordable education on an International level. After ten years of its launch, LEAD School became a unicorn with a valuation of $1.1 billion on January 13, 2022.

Today, the company is valued at $1.10 billion, making it one of the most valuable Edtech companies in India. LEAD School’s investors include WestBridge Capital, GSV Ventures, Elevar Equity.

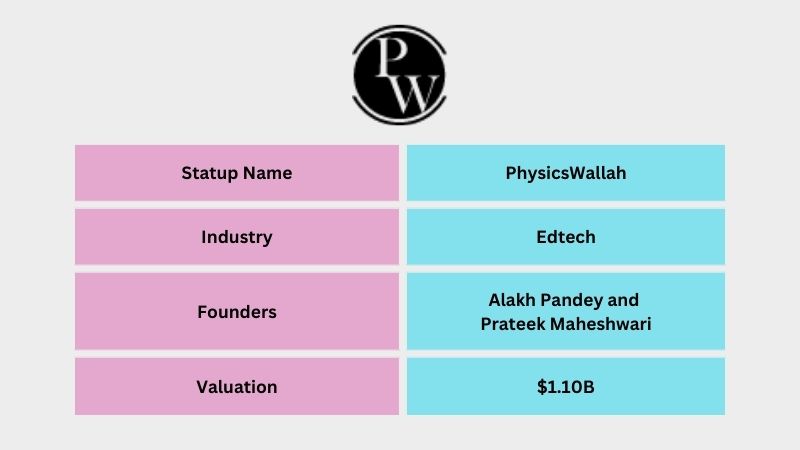

PhysicsWallah

PhysicsWallah is an Indian Edtech company founded by Alakh Pandey and Prateek Maheshwari. The company provides online as well as offline education rooms at affordable rates. Within six years of its launch, PhysicsWallah became a unicorn with a valuation of $1.1 billion on June 7, 2022.

Today, the company is valued at $1.10 billion, making it one of the most valuable Edtech companies in India. PhysicsWallah’s investors include SoftBank Group, Sequoia Capital India, Lightspeed India Partners.

Purple

Purplle is an Indian E-commerce & direct-to-consumer company founded by Manish Taneja. The company provides Online beauty products. After eleven years of its launch, Purplle became a unicorn with a valuation of $1.1 billion on June 9, 2022.

Today, the company is valued at $1.10 billion, making it one of the most valuable E-commerce & direct-to-consumer companies in India. Purplle’s investors include Blume Ventures, JSW Ventures, IvyCap Ventures.

Mamaearth

Mamaearth is an Indian E-commerce & direct-to-consumer company founded by Ghazal Alagh, and Varun Alagh. The company provides beauty products at affordable rates. Within five years of its launch, Mamaearth became a unicorn with a valuation of $1 billion on December 28, 2021.

Today, the company is valued at $1.07 billion, making it one of the most valuable E-commerce & direct-to-consumer companies in India. Mamaearth’s investors include Fireside Ventures, Sequoia Capital India, Stellaris Venture Partners.

Rivigo

Rivigo is an Indian travel company founded by Deepak Garg. The company provides a truck model where they help drivers. Within five years of its launch, Rivigo became a unicorn with a valuation of $1.07 billion on July 11, 2019.

Today, the company is valued at $1.07 billion, making it one of the most valuable travel companies in India. Oyo’s investors include SAIF Partners India, Warburg Pincus, Trifecta Capital Advisors.

BlackBuck

BlackBuck is an Indian Supply chain, logistics, & delivery company founded by Rajesh Yabaji, Chanakya Hridaya, Ramasubramanian, and Venkatesh Bhat. The company provides online trucking models. Within six years of its launch, BlackBuck became a unicorn with a valuation of $1 billion on July 22, 2021.

Today, the company is valued at $1.02 billion, making it one of the most valuable Supply chain, logistics, & delivery.

companies in India. BlackBuck’s investors include Accel, Sands Capital, International Finance Corporation.

Darwinbox

Darwinbox is an Indian Internet software & services company founded by Chaitanya Peddi, Jayant Paleti, and Rohit Chennamaneni. The company provides an end-to-end HR Technology platform for enterprises. After seven years of its launch, Darwinbox became a unicorn with a valuation of $1 billion on January 25, 2022.

Today, the company is valued at $1.00 billion, making it one of the most valuable Internet software & services companies in India. Darwinbox’s investors include Lightspeed India Partners, Sequoia Capital India, Endiya Partners.

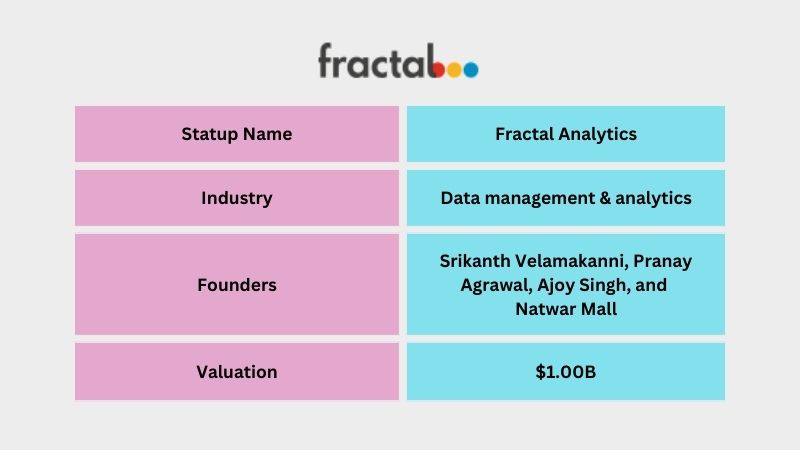

Fractal Analytics

Fractal Analytics is an Indian Data management & analytics company founded by Srikanth Velamakanni, Pranay Agrawal, Ajoy Singh, and Natwar Mall. The company helps to take decisions to the companies through AI and data. After ten years of its launch, Fractal Analytics became a unicorn with a valuation of $1 billion on January 5, 2022.

Today, the company is valued at $1.00 billion, making it one of the most valuable Data management & analytics companies in India. Fractal Analytics’s investors include TPG Capital, Apax Partners, TA Associates.

Hasura

Hasura is an Indian Internet software & services company founded by Rajoshi Ghosh and Tanmai Gopal. The company helps developers with tools. Within five years of its launch, Hasura became a unicorn with a valuation of $1 billion on February 22, 2022.

Today, the company is valued at $1.00 billion, making it one of the most valuable Internet software & services companies in India. Hasura’s investors include Nexus Venture Partners, Vertex Ventures, STRIVE.

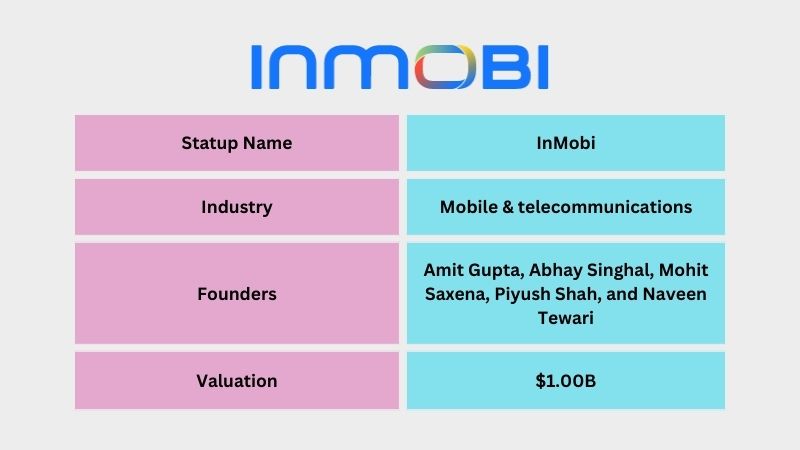

InMobi

InMobi is an Indian travel company founded by Amit Gupta, Abhay Singhal, Mohit Saxena, Piyush Shah, and Naveen Tewari. The company provides consumers to discover new products and services by providing contextual, relevant, and curated recommendations on mobile apps and devices. Within seven years of its launch, InMobi became a unicorn with a valuation of $1 billion on December 2, 2014.

Today, the company is valued at $1.00 billion, making it one of the most valuable travel companies in India. InMobi’s investors include Kleiner Perkins Caufield & Byers, Softbank Corp., Sherpalo Ventures.

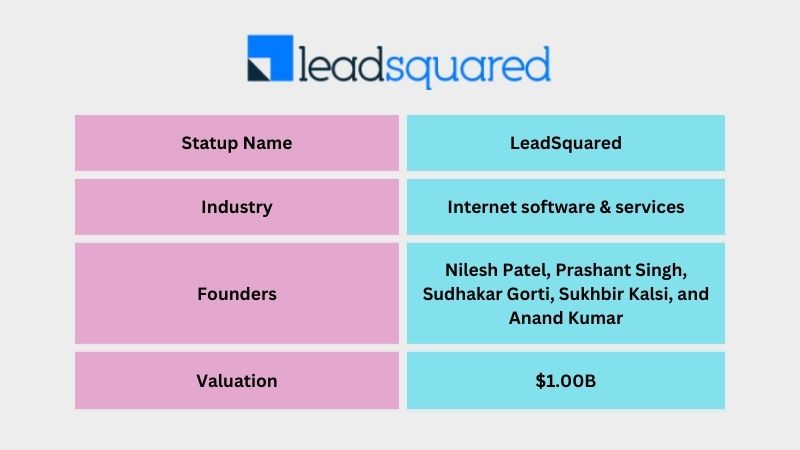

LeadSquared

LeadSquared is an Indian Internet software & services company founded by Nilesh Patel, Prashant Singh, Sudhakar Gorti, Sukhbir Kalsi, and Anand Kumar. The company offers marketing automation and sales execution to help businesses improve their sales outcomes by effectively managing their sales pipelines, and accurately attributing their return on investment (ROI) across various factors such as people, marketing activities, lead sources, products, and locations.

After eleven years of its launch, LeadSquared became a unicorn with a valuation of $1 billion on June 21, 2022.

Today, the company is valued at $1.00 billion, making it one of the most valuable Internet software & services companies in India. LeadSquared’s investors include Gaja Capital Partners, Stakeboat Capital, WestBridge Capital.

Licious

Licious is an Indian E-commerce & direct-to-consumer company founded by Abhay Hanjura and Vivek Gupta. The company provides meat and seafood products. Within six years of its launch, Licious became a unicorn with a valuation of $1 billion on October 10, 2021.

Today, the company is valued at $1.00 billion, making it one of the most valuable E-commerce & direct-to-consumer companies in India. Licious’s investors include 3one4 Capital Partners, Bertelsmann India Investments, Vertex Ventures SE Asia.

Mensa Brands

Mensa Brands is an Indian company founded by Ananth Narayanan, Pawan Kumar Dasaraju, and Aniket Nikumb. The company acquires local businesses as well as provides them with resources to grow. Within five years of its launch, Mensa Brands became a unicorn with a valuation of $1 billion on November 16, 2021.

Today, the company is valued at $1.00 billion, making it one of the most valuable companies in India. Mensa Brands’s investors include Accel, Falcon Edge Capital, Norwest Venture Partners.

MobiKwik

MobiKwik is an Indian Fintech company founded by Bipin Preet Singh, Upasana Taku, Chandan Joshi, and Saurabh Jain. The company offers a digital financial services platform. After eleven years of its launch, MobiKwik became a unicorn with a valuation of $1 billion on October 10, 2021.

Today, the company is valued at $1.00 billion, making it one of the most valuable Fintech companies in India. MobiKwik’s investors include Sequoia Capital India, The Times Group, GMO VenturePartners.

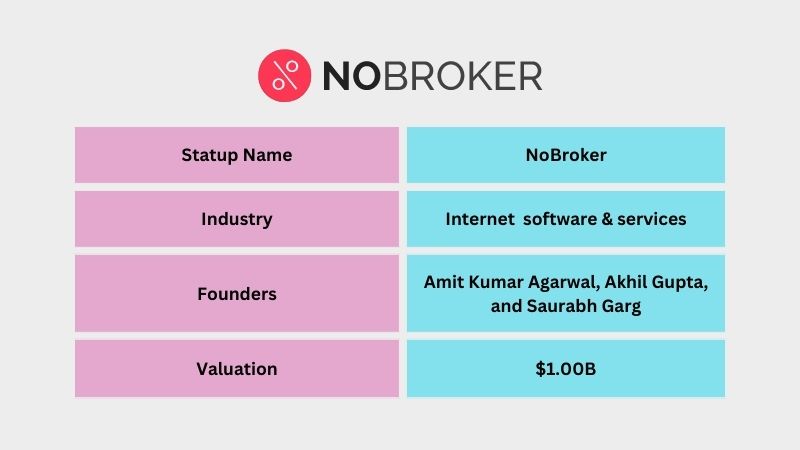

NoBroker

NoBroker is an Indian Internet software & services company founded by Amit Kumar Agarwal, Akhil Gupta, and Saurabh Garg. The company offers a real estate search portal that connects flat owners and tenants directly with each other. NoBroker became a unicorn with a valuation of $1 billion on November 11, 2021.

Today, the company is valued at $1.00 billion, making it one of the most valuable Internet software & services companies in India. NoBroker’s investors include General Atlantic, Elevation Capital, and BEENEXT.

Open

Open is an Indian Fintech company founded by Anish and Mabel Chacko. The company offers a banking platform for SMEs and start-ups.

Today, the company is valued at $1.00 billion, making it one of the most valuable Fintech companies in India. Open’s investors include 3one4 Capital Partners, Tiger Global Management, and Temasek.

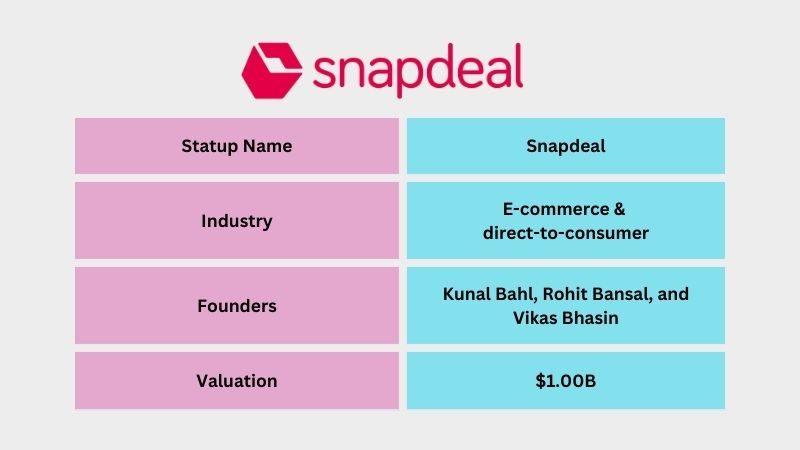

Snapdeal

Snapdeal is an Indian E-commerce & direct-to-consumer company founded by Kunal Bahl, Rohit Bansal, and Vikas Bhasin. The company provides an e-commerce platform for buyers and sellers both. Within four years of its launch, Snapdeal became a unicorn with a valuation of $1 billion on May 21, 2014.

Today, the company is valued at $1.00 billion, making it one of India’s most valuable E-commerce & direct-to-consumer companies. Snap deal’s investors include SoftBankGroup, Blackrock, and Alibaba Group.

1mg

1mg is an Indian Healthtech company founded by Gaurav Agarwal, Prashant Tandon, and Vikas Chauhan. The company provides a digital platform for consumer healthcare, including an online pharmacy center. Within seven years of its launch, 1mg became a unicorn with a valuation of $1.1 billion on September 2022.

Today, the company is valued at $1.1 billion, making it one of India’s most valuable Healthtech companies.

1mg’s investors include: MPOF Mauritius, Rubal Jain, MAF Mauritius, HBM Healthcare Investments AG, Tata Digital, KWE Beteiligungen, Vardaan Sharma, Tata Group, International Finance Corporation, Bill & Melinda Gates Foundation, Sequoia Capital, Kae Capital, Maverick Ventures, Corisol Holding AG, Omidyar Network, Redwood Global Healthcare Fund, InnoVen Capital, Sequoia Capital India, Ajeet Khurana, Intel Capital.

BrowserStack

BrowserStack is an Indian enterprise tech company founded by Nakul Aggarwal and Ritesh Arora. The company offers developers immediate access to a cloud-based platform that enables them to perform comprehensive testing of their websites and mobile applications on over 2,500 real devices and browsers. After ten years of its launch, Browserstack became a unicorn with a valuation of $4.0 billion on June 2021.

Today, the company is valued at $4.0 billion, making it one of India’s most valuable Enterprise tech companies. Browserstack’s investors include Accel and Bond Capital.

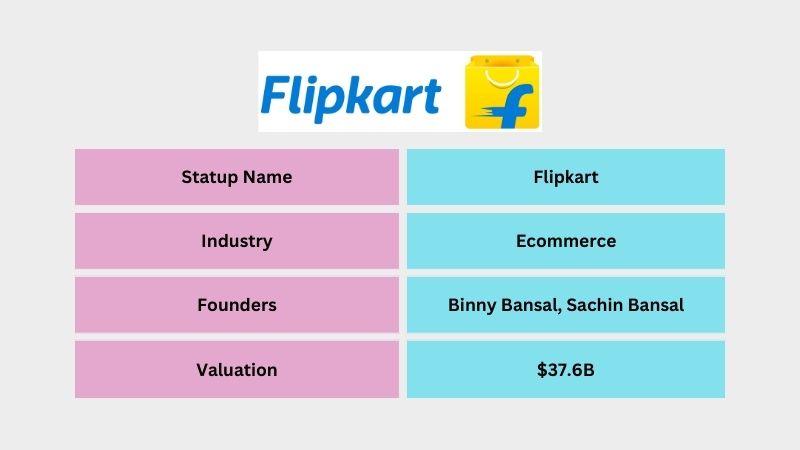

Flipkart

Flipkart is an Indian Ecommerce company founded by Binny Bansal, and Sachin Bansal. The organization provides an online marketplace that serves as a connection point for buyers and sellers. within five years of its launch, Flipkart became a unicorn on March 2012.

Today, the company is valued at $37.6 billion, making it one of India’s most valuable Ecommerce companies. Flipkart’s investors include Accel, Axis Bank, Canada Pension Plan Investment Board, DST Global, eBay, Flipkart, GIC, Naspers, SoftBank Vision Fund, Steadview Capital, Tencent, Tiger Global Management, and Walmart.

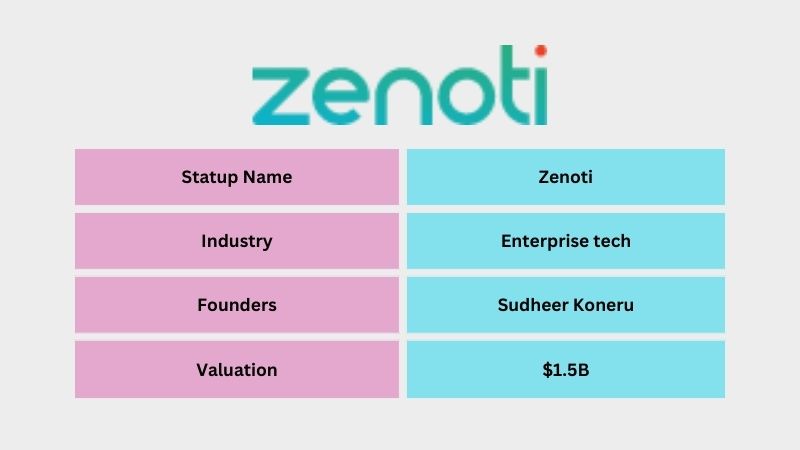

Zenoti

Zenoti is an Indian Enterprise tech company founded by Sudheer Koneru, and Dheeraj Koneru. The company provides cloud-based software solutions, including online appointment bookings, mobile check-in, and check-out, point of sale (POS), customer relationship management (CRM), employee management, inventory management, and built-in marketing programs. After ten years of its launch, Blackbuck became a unicorn with a valuation of $1.5 billion on December 2020.

Today, the company is valued at $1.5 billion, making it one of India’s most valuable Enterprise tech companies. Zenoti’s investors include Advent International, Tiger Global Management, Steadview Partners, Norwest Venture Partners, Accel Partners, and TPG.

BigBasket

BigBasket is an Indian Consumer Services company founded by VS Sudhakar, Hari Menon, Vipul Parekh, VS Ramesh, Abhinay Choudhari. The company offers online Grocery shopping. After eight years of its launch, BigBasket became a unicorn with a valuation of $1.8 billion in 2019.

Today, the company is valued at $1.8 billion, making it one of India’s most valuable Consumer Services companies. BigBasket’s investors include Alibaba Group, Helion Venture Partners, Paytm Mall, Bessemer Venture Partners, LionRock Capital, Abraaj Group, Trifecta Capital Advisors, Ascent Capital, & Mirae Asset Global Investments.

Chargebee

Chargebee is an Indian Fintech company founded by Kp Saravanan, Thiyagarajan T, Rajaraman Santhanam, and Krish Subramanian. The organization provides a tool for managing recurring billing and subscriptions, which aids in optimizing the Revenue Operations (RevOps) of subscription-based businesses.

Today, the company is valued at $3.5 billion, making it one of India’s most valuable Fintech companies. Chargebee’s investors include Accel, Insight Partners, Tiger Global Management, Sapphire Ventures, Steadview Capital

Uniphore

Uniphore is an Indian Enterprise tech company founded by Ravi Saraogi, and Umesh Sachdev. The company offers a customer service platform driven by artificial intelligence and automation technologies. Fourteen years of its launch, Amagi became a unicorn with a valuation of $2.5 billion on February 2022.

Today, the company is valued at $2.5 billion, making it one of India’s most valuable Enterprise tech companies. Uniphore’s investors include Chiratae Ventures, March Capital, New Enterprise Associates

Postman

Postman is an Indian Enterprise tech company founded by Abhinav Asthana, Abhijit Kane, and Ankit Sobti. The company offers a collaboration platform for API development. within six years of its launch, Postman became a unicorn with a valuation of $2.0 billion in 2020.

Today, the company is valued at $5.6 billion, making it one of the most valuable Enterprise tech companies in India. Postman’s investors include CRV, Insight Partners, Nexus Venture Partners

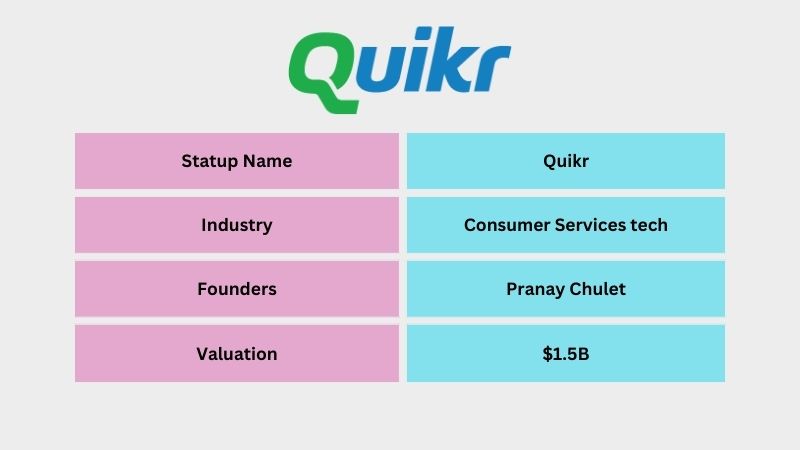

Quikr

Quikr is an Indian Consumer Services tech company founded by Pranay Chulet. The company provides an online marketplace for users to sell, buy, rent, or explore a wide range of items throughout India. After seven years of its launch, Quikr became a unicorn with a valuation of $1.5 billion on March 2015.

Today, the company is valued at $1.5 billion, making it one of the most valuable Consumer Services companies in India. Quikr’s investors include Kinnevik AB, Brand Capital, Tiger Global Management, NGP Capital, Warburg Pincus, Northwest Venture Partners, Omidyar Network, InnoVen Capital, Trifecta Capital Advisors

Renew Power

Renew Power is an Indian Energy Tech company founded by Sumant Sinha. The company offers renewable energy. After six years of its launch, Renew Power became a unicorn with a valuation of $1.8 billion on March 2022.

Today, the company is valued at $3.2 billion, making it one of the most valuable Energy Tech companies in India. Renew Power’s investors include Goldman Sachs, Franklin Templeton India, JP Morgan, L&T, Canada Pension Plan Investment Board, OPIC – Overseas Private Investment Corporation, Asian Development Bank, Abu Dhabi Investment Authority, Yes Bank, JERA

Glance

Glance is an Indian Media & Entertainment company founded by Naveen Tewari. The company provides tailored content on users’ lock screens in their preferred language. Within two years of its launch, Glance became a unicorn with a valuation of $1.6 billion in 2020.

Today, the company is valued at $1.60 billion, making it one of the most valuable Media & Entertainment companies in India. Glance’s investors include Google, Mithril Capital

Hike

The Hike is an Indian Media & Entertainment company founded by Kavin Bharti Mittal. The company offers messaging services. Within four years of its launch, Amagi became a unicorn with a valuation of $1.4 billion on August 2016.

Today, the company is valued at $1.4 billion, making it one of the most valuable Media & Entertainment companies in India. Hike’s investors include Greycroft, Eight Road Ventures, Ignition Partners, Meritech Capital Partners, B Capital Group, PremjiInvest

Icertis

Icertis is an Indian Enterprise tech company founded by Monish Darda, and Samir Bodas. The company provides contract lifecycle management services and is dedicated to advancing the possibilities of contract intelligence. After ten years of its launch, Icertis became a unicorn with a valuation of $1.0 billion on July 2019.

Today, the company is valued at $5.0 billion, making it one of the most valuable Enterprise tech companies in India. Icertis’s investors include PremjiInvest, Meritech Capital Partners, B Capital Group, Ignition Partners, Greycroft, and Eight Roads Ventures

Zerodha

Zerodha is an Indian Fintech company founded by Nithin Kamath, Nikhil Kamath, and Kailash Nadh. The company provides retail and institutional broking services, as well as trading and distribution services. After ten years of its launch, Amagi became a unicorn with a valuation of $1.0 billion on June 2020.

Today, the company is valued at $2.0 billion, making it one of the most valuable Fintech companies in India.

EaseMyTrip

EaseMyTrip is an Indian Travel Tech company founded by Nishant Pitti, Prashant Pitti, and Rikant Pitti. The company offers a variety of travel services such as flight booking, hotel booking, etc After thirteen years of its launch, Amagi became a unicorn with a valuation of $1.0 billion in 2021.

Today, the company is valued at $1.0 billion, making it one of the most valuable Travel Tech companies in India. Travel Tech’s investors include Nomura Holdings.

MapmyIndia

MapmyIndia is an Ecommerce company founded by Rakesh Verma. The company offers digital maps, navigation, software, etc. After twenty-six years of its launch, MapmyIndia became a unicorn with a valuation of $1.0 billion in 2021.

Today, the company is valued at $1.0 billion, making it one of the most valuable Ecommerce companies in India. MapmyIndia’s investors include Nomura, Morgan Stanley, Goldman Sachs, Lightbox.

Druva

Druva is an Indian Enterprise tech company founded by Jaspreet Singh, Milind Borate, and Ramani Kothandaraman. the company offers protection and manages enterprise data across edge, on-premises, and cloud workloads. After eleven years of its launch, Druva became a unicorn with a valuation of $1.0 billion on April 2019.

Today, the company is valued at $2.0 billion, making it one of the most valuable Enterprise tech companies in India. Druva’s investors include Sequoia Capital India, Nexus Venture Partners, Caisse de Depot et Placement du Quebec, Indian Angel Network, Viking Global Investors, Orios Venture Partners, Riverwood Capital.

Innovaccer

Innovaccer is an Indian Healthtech company founded by Kanav Hasija, Abhinav Shashank, and Sandeep Gupta. The company offers population health management and pay-for-performance solutions for healthcare providers, including physician practices, hospitals, and health systems. After seven years of its launch, Innovaccer became a unicorn with a valuation of $1.3 billion in February 2021.

Today, the company is valued at $3.2 billion, making it one of India’s most valuable Healthtech companies. Innovaccer’s investors include Sequoia Capital, B Capital Group, 500 Startups, M12 – Microsoft’s Venture Fund.

Zeta

Zeta is an Indian Fintech company founded by Bhavin Turakhia, and Ramki Gaddipati. The company offers a modern core and processing for financial institutions and embeddable banking for fintech and distributors. After six years of its launch, Zeta became a unicorn with a valuation of $1.5 billion in 2021.

Today, the company is valued at $1.5 billion, making it one of the most valuable Fintech companies in India. Zeta’s investors include Sodexo.

Paytm Mall

Paytm Mall is an Indian Ecommerce company founded by Vijay Shekhar Sharma. The company offers an online marketplace. within two years of its launch, Amagi became a unicorn with a valuation of $1.9 billion in 2018.

Today, the company is valued at $2.9 billion, making it one of India’s most valuable Ecommerce companies. Paytm Mall’s investors include Softbank Vision Fund, Alibaba Group, eBay.

Paytm

Paytm is a Fintech company founded by Vijay Shekhar Sharma. The company offers financial services and mobile payment. within five years of its launch, Amagi became a unicorn with a valuation of $1.8 billion in 2015.

Today, the company is valued at $5.9 billion, making it one of the most valuable Fintech companies in India. Paytm’s investors include SoftBank, Alibaba, Berkshire Hathaway, SAIF Partners, Intel Capital, and SAP Ventures.

Moglix

Moglix is an Indian Ecommerce company founded by Rahul Garg. The company offers a B2B marketplace for Industrial goods. After six years of its launch, Moglix became a unicorn with a valuation of $1.0 billion on May 2021.

Today, the company is valued at $2.3 billion, making it one of the most valuable Ecommerce companies in India. Moglix’s investors include Alpha Wave Global, Tiger Global Management, Harvard Management Company, Sequoia Capital India.

Gupshup

Gupshup is an Indian Enterprise tech company founded by Beerud Sheth. The company offers a platform that enables engaging conversations.

Seventeen years of its launch, Amagi became a unicorn with a valuation of $1.4 billion on April 2021.

Today, the company is valued at $1.4 billion, making it one of the most valuable Enterprise tech companies in India. Gupshup’s investors include Bharti SoftBank, Tiger Global Management, Tencent Holdings, Foxconn Technology Group.

Good Glamm Group

Good Glamm Group is an Indian Ecommerce company founded by Darpan Sanghvi. The company offers beauty products. within six years of its launch, Good Glamm Group became a unicorn with a valuation of $1.2 billion on March 2022.

Today, the company is valued at $1.2 billion, making it one of the most valuable Ecommerce companies in India. Good Glamm Group’s investors include Abu Dhabi Capital Group, Bennett Coleman & Co, Grofers International, Sequoia Capital India, SoftBank Vision Fund, Tiger Global Management, and Trifecta Capital Advisors.

Mindtickle

Mindtickle is an Indian Enterprise tech company founded by Krishna Depura, Deepak Diwakar, and Nishant Mungali. The company offers a sales readiness and enablement platform that is data-driven and comprehensive, allowing for onboarding, micro-learning, coaching, and skills development. After ten years of its launch, Mindtickle became a unicorn with a valuation of $1.2 billion in 2021.

Today, the company is valued at $1.2 billion, making it one of India’s most valuable Enterprise tech companies. Mindtickle’s investors include Abu Dhabi Investment Authority, Sequoia Capital India, and InnoVen Capital.

Info Edge

Info Edge is an Indian Consumer Services company founded by Sanjeev Bikhchandani. The company offers top-tier online classified services in areas such as recruitment, matrimony, real estate, education, and related fields. After nineteen years of its launch, Info Edge became a unicorn with a valuation of $2.1 billion in 2014.

Today, the company is valued at $8.2 billion, making it one of the most valuable Consumer Services companies in India. Info Edge’s investors include Accel, Alteria Global, Evolvence India Fund, InnoVen Capital, Nexus Venture Partners, Tiger Global Management, and Trifecta Capital Advisors.

Freshworks

Freshworks is an Indian Enterprise tech company founded by Girish Mathrubootham, and Shan Krishnasamy. The company offers Customer Support and Marketing Automation. After eight years of its launch, Freshworks became a unicorn with a valuation of $1.5 billion in November 2018.

Today, the company is valued at $4.8 billion, making it one of the most valuable Enterprise tech companies in India. Freshworks’s investors include Accel Partners, Sequoia Capital, Sequoia Capital India, Tiger Global Management, CapitalG, Steadview Capital.

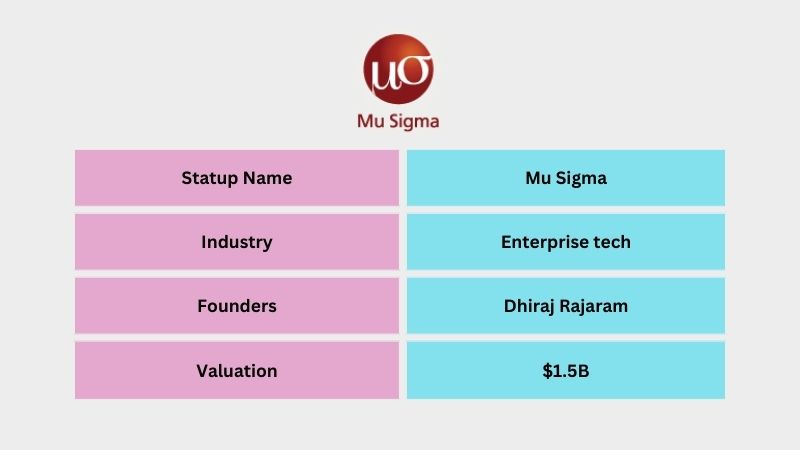

Mu Sigma

Mu Sigma is an Indian Enterprise tech company founded by Dhiraj Rajaram. The company offers play data analytics firm by providing data science solutions. After nine years of its launch, Mu Sigma became a unicorn with a valuation of $1.5 billion in 2013.

Today, the company is valued at $1.5 billion, making it one of the most valuable Enterprise tech companies in India. Mu Sigma’s investors include Mastercard, General Atlantic, Sequoia Capital India, FTV Capital.

IndiaMART

IndiaMart is an Indian Ecommerce company founded by Brijesh Agrawal, and Dinesh Agarwal. The company offers an online marketplace for buyers and sellers. After twenty-four years of its launch, IndiaMart became a unicorn with a valuation of $1.8 billion in 2020.

Today, the company is valued at $1.89 billion, making it one of the most valuable Ecommerce companies in India. IndiaMart’s investors include Mela Ventures, 1Crowd, and Chennai Angels.

Verse Innovation

Verse Innovation is an Indian Media & Entertainment company founded by Virendra Gupta and Umang Bedi. The company provides short video-sharing and news apps. After eleven years of its launch, Verse Innovation became a unicorn with a valuation of $1.8 billion in 2020.

Today, the company is valued at $4.2 billion, making it one of the most valuable Media & Entertainment companies in India. Verse Innovation’s investors include Omidyar Network, Matrix Partners India, Sequoia Capital India, Citco, Falcon Edge Capital, ByteDance, Arun Sarin, Toutiao, Stonebridge Capital Advisors, Advent Management, Lupa Systems.

5ire

5ire is an Indian Deeptech company founded by Prateek Dwivedi, Pratik Gauri, and Vilma Mattila. The company provides a blockchain ecosystem. within one year of its launch, 5ire became a unicorn with a valuation of $1.5 billion in 2022.

Today, the company is valued at $1.5 billion, making it one of the most valuable Deeptech companies in India. 5ire’s investors include The Global Emerging Markets Group, Launchpool, Sanctum Global Ventures.

Oxyzo

Oxyzo is an Indian Media & Entertainment company founded by Asish Mohapatra and Ruchi Kalra. The company offers tailored credit solutions to aid in the growth of small and medium-sized businesses (SMEs), allowing them to expand their operations and increase their revenue and profitability. within six years of its launch, Oxyzo became a unicorn with a valuation of $1.0 billion in 2022.

Today, the company is valued at $1.0 billion, making it one of the most valuable Media & Entertainment companies in India. Oxyzo’s investors include Tiger Global Management, Norwest Venture Partners, Matrix Partners.

National Stock Exchange of India

National Stock Exchange of India is an Indian Enterprise Fintech company. The company offers a stock exchange facility. After twenty-four years of its launch, the National Stock Exchange of India became a unicorn with a valuation of $1 billion in July 2020.

Today, the company is valued at $6.50 billion, making it one of the most valuable Enterprise tech companies in India. Mu Sigma’s investors include TA Associates, SoftBank Group, and GS Growth.

Vedantu

Vedantu is an Indian edtech company founded by Vamsi Krishna, Pulkit Jain and Anand Prakash. The company offers online learning. Ten years after its launch, Vedantu became a unicorn on September 29, 2021, with a valuation of $1 billion.

Today, the company is valued at $1.00 billion, making it one of the most valuable travel companies in India. Vedantu Investors Excel, Tiger Global Management, Omidyar Network.

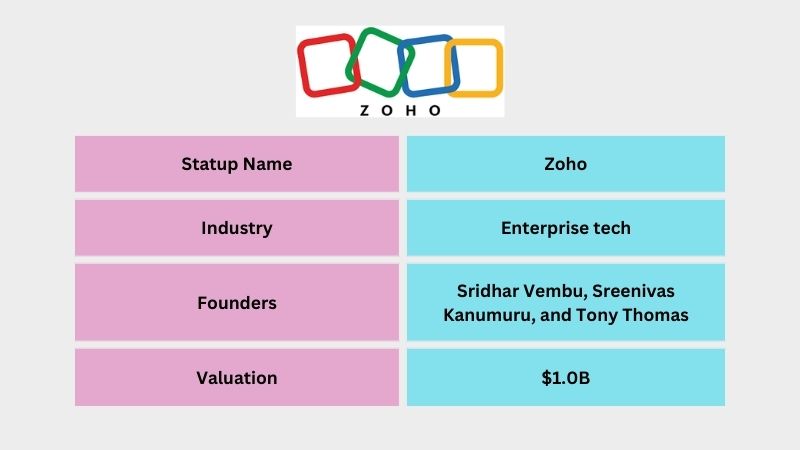

Zoho

Zoho is an Indian Enterprise tech company founded by Sridhar Vembu, Sreenivas Kanumuru, and Tony Thomas.

The company offers software and web-based business tools. Today, the company is valued at $1.0 billion, making it one of India’s most valuable Enterprise tech companies.

Shopclues

Shopclues is an Indian Ecommerce company founded by Sandeep Aggarwal, Sanjay Sethi, and Radhika Aggarwal. The company offers an e-commerce marketplace for buyers and sellers both. Within five years of its launch, Shopclues became a unicorn with a valuation of $1.1 billion on January 2016.

Today, the company is valued at $1.1 billion, making it one of India’s most valuable E-commerce companies. Shopclues’s investors include Helion Venture Partners, Nexus Venture Partners, GIC, Tiger Global Management, InnoVen Capital, Unilazer Ventures, Clues Network.

Droom

Droom is an Indian Ecommerce company founded by Sandeep Aggarwal, and Rishabh Malik. The company offers an online marketplace for selling and buying used and new cars and bikes. After seven years of its launch, Droom became a unicorn with a valuation of $1.2 billion in 2021.

Today, the company is valued at $1.2 billion, making it one of the most valuable Ecommerce companies in India. Droom’s investors include 57 Stars, BEENEXT, Digital Garage, Integrated Capital, Joe Hirao, Lightbox Ventures, and Toyota Tsusho Corporation.

Zomato

Zomato is an Consumer Services company founded by Pankaj Chaddah, Deepinder Goyal and Gaurav Gupta. The company offers an online marketplace for restorents to provide food.

Today, the company is valued at $ 8.6 billion, making it one of the most valuable food tech companies in India.

Nykaa

Nykaa is a beauty and lifestyle retail company Nykaa founded by Falguni Nayar. Nykaa, an online e-commerce platform for beauty and personal care products.

Today, the company is valued at $11.2 billion, making it one of the most valuable Ecommerce companies in India.

PharmEasy

PharmEasy is a healthtech company founded by Dharmil Sheth, Dhaval Shah and Mikhil Innani. PharmEasy, an online e-commerce platform for health and personal care products.

Today, the company is valued at $5.6 billion, making it one of the most valuable Ecommerce companies in India.

Delhivery

Delhivery is a logistics company founded by Bhavesh Manglani, Kapil Bharati, Mohit Tandon, Sahil Barua, and Suraj Saharan. Delhivery, is an online logistics platform for e-commerce products.

Today, the company is valued at $5 billion, making it one of the most valuable logistics companies in India.

Blinkit

blinkit is a consumer service company founded by Albinder Dhindsa and Saurabh Kumar. Blinkit, is an consumer service platform for e-commerce products.

Today, the company is valued at $1 billion, making it one of the most valuable logistics companies in India.

BillDesk

Billdesk is a fintech company founded by Ajay Kaushal, Karthik Ganapathy and Srinivasu Mn.

Today, the company is valued at $2.5 billion, making it one of the most valuable logistics companies in India.

Zepto

Zepto, India’s fastest-growing e-grocery company, was founded in 2021 by Stanford University dropouts Aadit Palicha and Kaivalya Vohra.

Following its recent Series-E fundraising of $200 Million from prestigious global investors including StepStone Group, Nexus Venture Partners, Glade Brook Capital, Lachy Groom, and others, Zepto is valued at $1.4 billion.

कृत्रिम (Krutrim)

कृत्रिम (Krutrim) Becomes Country’s Fastest Unicorn with $50 Mn Funding.

With this remarkable accomplishment, कृत्रिम becomes not just the fastest unicorn in India but also the country’s first artificial intelligence unicorn, a milestone that is noteworthy for both the company and the Indian IT sector. The money raised will play a key role in helping the business accelerate its goals of changing the AI environment, spurring innovation, and becoming globally recognized.

Recently, Bhavish Aggarwal, Ola’s CEO and creator, said that high-caliber translation APIs for English to/from Indian languages will be available shortly on the Krutrim cloud for text, speech, and video modalities.

On May 2, 2024, Krutrim published an Android app that can be downloaded from the Google Play Store.

Porter

Porter, a logistics services company funded by Tiger Global, has become a unicorn following the completion of a new friends and family round in which investors purchased stock from the employee stock ownership plan (ESOP) pool at a $1 billion valuation, Moneycontrol reported.

After B2B SaaS startup Perfios and AI startup Krutrim, Porter is the third unicorn of the year.

Explore More Startups Ideas With VIESTORIES

Finally, India’s unicorn startups demonstrate its entrepreneurial spirit and startup ecosystem potential. These startups are disrupting sectors, solving social issues, growing the economy, and creating jobs. The Indian government and business sector are supporting startups despite regulatory constraints and tough competition. Unicorn startups will continue to shape India’s economy and society, and more inventive enterprises will reach this coveted status in the future.

This was the List of Unicorn Startups in India. We hope this is useful to you. The order of this list is random.

Frequently Asked Questions (FAQs)

What is a unicorn startup?

A unicorn startup is a privately held company that is valued at over $1 billion.

How many unicorns are there in India?

India is home to over 108 unicorns, and the number is expected to grow in the coming years.

Which are the Top 10 Unicorn Startups in India?

BillDesk, Dream11, Zerodha, Zoho, EaseMyTrip, Gupshup, Infra.Market, Shiprocket, Mamaearth, and Nykaa are the Top 10 Unicorn Startups in India.

Which sectors have the most unicorn startups in India?

E-commerce, fintech, edtech, and healthtech are some of the sectors with the most unicorn startups in India.

How are unicorn startups contributing to the economy?

Unicorn startups are fostering innovation, addressing social issues, and producing jobs, all of which help the Indian economy expand.