A Range of investing possibilities has grown beyond conventional channels as the digital age continues to change the financial environment. One such root that is increasing in popularity is investing in e-gold, which allows people to do so online. The attractiveness of gold as a timeless investment has discovered a new root in an era where financial landscapes are fast shifting in the shape of e-gold.

Read also – List of Startups Funded By Rajan Anandan

India is leading this shift as conventional investing methods merge with cutting-edge technology by providing a variety of venues that let people buy gold online. This platform not only makes it convenient to invest in E-Gold but also gives investors a secure and convenient alternative to expand their portfolios. The major platforms for investing in e-hold in India in 2024 will be covered in detail in the article, along with information on their features, advantages, and the shifting investment landscape.

Read also – Top 10 Best Startup Business Grants Around the World

Ten Best Platforms For Investment in E-Gold in India in 2024

Here is the list of the Top 10 Platforms For Investment in E-Gold in India in 2024

1. National Spot Exchange Limited

In the field of e-gold trading, NSEL stands for National Spot Exchange Limited and has emerged as a leader in establishing new benchmarks for dependability and creativity. It was founded as a division of Financial Technologies India Limited and it has gained a reputation for its innovative ideas and reliable trading infrastructure.

Read also – Top 10 Best Agri Fintech Startups in India in 2024

The platform has an intuitive user interface that makes it approachable to both experienced investors and market beginners. NSEL’s beauty among Indian investors has been largely attributed to its dedication to efficiency and openness. The trade volume of gold increased by an astonishing 40% in the fiscal year 2022 and 23% compared to the prior year according to the NSEL.

2. Paytm Money

By providing a fluid and user-friendly platform, Paytm Money has established a unique place for itself in the realm of e-gold investing. Paytm Money is an excellent option for investors looking to diversify their portfolios with the everlasting attraction of gold by using its powerful online infrastructure and easy-to-use interface. Paytm Money contributes a special fusion of ease and safety to the e-gold trading scene thanks to its standing as a dependable fintech pioneer.

Read also – 20 Profitable Small Business Ideas for Rural Villages 2024

Paytm Money experienced a 60% rise in customer enrollment on its e-gold system during the first half of 2024. Platform excellent INR 150 crore typical acids under supervision for e-gold investment is proof of its expanding market share. Paytm Money keeps coming up with new ideas.

3. Upstox

Upstox has established itself as a major participant in the stock market because of 28 user-centric strategies and affordable trading products. It has gained a devoted user base of investors looking for a simplified investment experience by integrating an easy-to-use interface with reasonable pricing. Upstox has expanded its selection to accommodate a variety of investor tastes by adding e-gold investments, opening a door to the community of digital payments.

Read also – List of startups funded by Sachin Tendulkar

During the same time frame, the average trade volume for gold investments on the platform Upstox impressively surpassed 200 kilograms. Its entry into the e-hold investing market under 9 is its commitment to providing investors with easily accessible means of diversifying and expanding their portfolios as it works to link the disconnection between technology and Finance.

4. Zerodha

An Additional layer of innovation has been added to Zerodha’s portfolio by expanding its reach into the e-hold trading space. It is a revolutionary discount brokerage. With its track record as a financial sector disruptor, it now provides a smooth investment environment for Digital gold. The platform’s dedication to user pleasure is demonstrated by the array of cutting-edge tools it offers, which equip users with the knowledge they need to make wise decisions and pave the way for an exciting and lucrative e-gold investment experience.

Read also – Top 10 Best Platforms for Creating and Selling Courses in 2024

In the first half of the year, Zerodha saw a significant 40% increase in the overall e-gold investment accounts open on its platform, demonstrating quick adoption. For e-gold investments on Zerodha, the average trade volume topped an astonishing 300 kilograms indicating significant participation.

5. Reliance Money

In the world of e-gold investing, Reliance Money shines as a lighthouse of convenience, providing investors with an easy-to-use online platform to explore. Reliance Money offers a reliable option for people looking for a credible forum to diversify their financial accounts through investments in digital gold by using its strong brand presence and reputation.

Read also – 5 Best Online Learning Platforms to Take Teaching to a New Level

Investors seeking a dependable and effective way to participate in the world of e-gold find the platform’s user-friendly interface and commitment to customer satisfaction to be appealing. The total amount of e-gold savings accounts open on Reliance Money’s platform has increased noticeably by 15% this year, indicating continued development. The average transaction value for investment on the platform increased significantly to INR 1.2 crore, indicating tremendous involvement.

6. Angel Broking

A Flexible e-gold investing platform that can accommodate both experienced and seasoned investors, Angel broking emerges. Angel broking, which places a strong emphasis on inclusion, offers a simple way for people of all skill levels to explore the world of investing in digital gold. Beyond its approachable nature, the platform stands out by providing actual-time information and college that are essential for making informed decisions.

Read also – Top 10 Best Crowdfunding Platforms in India in 2024 | Indian Crowdfunding Sites

Angel Broking noticed a significant 25% increase in new gold buyers joining its platform in the previous fiscal year, demonstrating its rising popularity. The platform’s real insights and updates functionality had an exceptional average user engagement time of more than 10 minutes for each session.

7. Kotak Securities

The Prestigious Kotak Mahindra Bank subsidiary Kotak Securities appears as a not-worth platform that enables investors to trade e-gold units with ease. Kotak securities provide a distinctive blend of dependability and creativity in the world of digital gold investments because of its long history and affiliation with a reputable financial institution.

Read also – Top 10 Content Curation Tools: Streamlining Your Content Strategy

Investors benefit from the assurance that comes with belonging to a recognized financial group which promotes confidence and trustworthiness There are gold endeavours. E-gold average transaction value for the platform exceeded INR 2 crore, indicating significant interest and involvement. Kotak securities received an 88% customer satisfaction rating, reaffirming its dedication to providing investors with a positive and secure experience.

8. HDFC Securities

Through its advanced trading platform, HDFC Securities, a major leader in the financial services industry, uses its range of products to provide an e-gold investment option. Utilizing the breadth of its clientele, HDFC security easily incorporates e-gold investments, meeting the various demands of investors.

Read also – Top 10 Sales Management Tools in 2024

The Platform, which is renowned for its dedication to user-friendliness, makes sure that investors both seasoned and newcomers may easily discover the world of digital e-gold. The number of E- Gold trades made through the HDFC Securities platform increased by an astonishing 25% over the previous six months. During the same period, the site’s Average Trade Value for E-Gold investment exceeded INR 1.5 crore, demonstrating significant involvement.

9. Multi Commodity Exchange

The Multi Commodity Exchange is a reputable platform with a strong reputation for success in commodity dealings, with E-Gold being one of its standout products. MCX expands its experience to the terrain of investing in digital gold as a dependable route for investors looking for contact with the ever-changing field of commodities. The platform stands out for its dedication to openness which guarantees that customers have a source of up-to-date information.

Read also – Top 10 Online Money Making Strategies: The Complete Overview

With its reputation for liquidity and extensive toolkit, it equips investors with the knowledge and tools necessary to successfully negotiate the challenges of e-gold trading. A significant 20% rise in trade turnover for e-gold for the fiscal years 2022 and 23 was recorded by MCX, indicating an increased appetite for investors in digital gold investments.

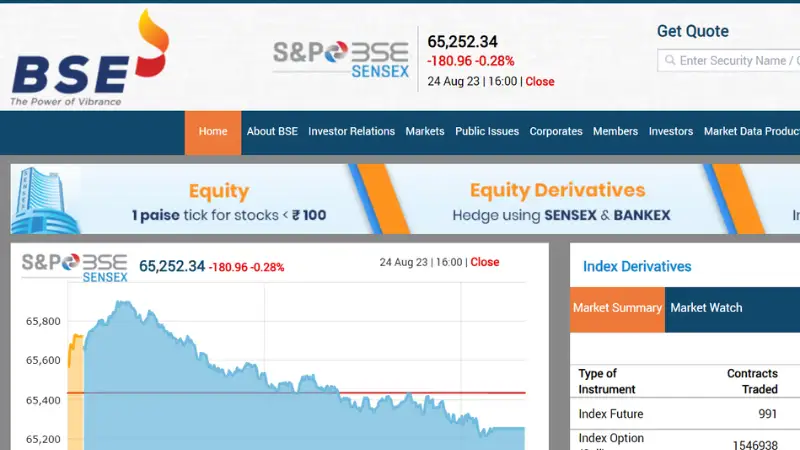

10. The Bombay Stock Exchange

Through its specialized service, the Bombay Stock Exchange platform has entered the realm of e-gold investments. This groundbreaking product demonstrates the Bombay Stock Exchange’s dedication to providing investors with a quick and easy way to buy digital gold.

Read also – Top 10 Defence Tech Startups Making India Atmanirbhar in 2024

Bombay Stock Exchange brings its contingency and credibility to the table as one of India’s top stock exchanges, ensuring customers of a secure and dependable platform to research e-gold investments. In the first quarter of 2024, customer registration for e-gold investments on the Bombay Stock Exchange platform increased by an astounding 35%.

Conclusion

E-gold investment has become popular in India as a cutting-edge and practical method of diversifying investment portfolios. The platforms outlined in this block post give investors a variety of choices, each with special features and advantages. Investors can make wise choices depending on their tastes and investment objectives with the statistical data showcasing things with increased interest and activity on these platforms. Before making any investment decision, keep in mind to conduct comprehensive Research and speak with financial professionals.

This was our selection of the Top Ten Platforms for Investment in E-Gold in India in 2024. We hope this is useful to you. The order of this list is random.

Read also – Top 20 Most Active Angel Investors in India’s Startup Ecosystem

Frequently Asked Questions (FAQs)

What is E-Gold?

E-gold can be explained or defined as a digital gold currency operated by gold and silver reserve that allow customers to make payments which is popularly known as ‘spends’.

Is it good to invest in E-Gold?

Yes, it is worth it to invest in e-gold as there is no worry about theft or any kind of loss.

Which are the Top Ten Platforms for Investment in E-Gold in India in 2024?

National Spot Exchange Limited, Paytm Money, Upstox, Zerodha, Reliance Money, Angel Broking, Kotak Securities, HDFC Securities, Multi Commodity Exchange, and The Bombay Stock Exchange are the Top Ten Platforms for Investment in E-Gold in India in 2024.

.