Investing in traditional platforms such as stocks, fixed deposits, and mutual funds, is not the only option for Indian investors. Today, there are lots of alternative investment platforms where anyone can easily access lots of opportunities.

Many people are taking an interest in alternative investment. Today, we will see some top Alternative Investment Platforms in India

Top 10 Alternative Investment Platforms in India

Here is the list of the Best 10 Alternative Investment Platforms in India

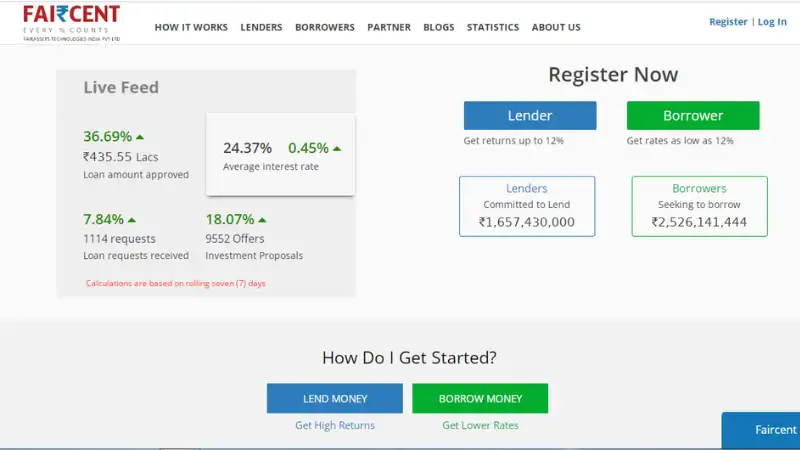

1. Faircent

Faircent is an India-based platform, where that operates as a peer-to-peer lending platform. The platform stands as one of the best alternative investment platforms. It is the first peer-to-peer (P2P) lending platform in the country that received a Certificate of Registration (CoR) from the Reserve Bank of India (RBI) as an NBFC-P2P.

Read also – Top 50 Fintech Startups in India | Indian Fintech Startups in 2024

It is one of the best alternatives for traditional financial intermediaries such as banks, Banks often control everything for both lenders and borrowers. It creates a virtual marketplace where borrowers and lenders can connect directly.

2. Tyke

Tyke is a cloud-based platform and one of India’s top alternative investment choice platforms. It helps in investing in private companies, especially in start-ups. With the help of a dashboard, users can easily monitor their portfolio performance as well as track investments and KPIs.

Read also – Top 10 Growing Startup Sectors in India

It simplifies the fundraising process, allowing investors to support excellent firms. It helps in automating private equity investing processes.

3. 13Karat

13Karat stands as a P2P-enabled investment platform where they provide investors with an annual return of up to 13%. In collaboration with RBI-registered P2P NBFCs, to make sure everything follows rules.

It’s open for everyone, NRIs, and as well soon for corporates. Every investment here is managed and monitored by an RBI-regulated trustee.

Read also – Top 10 Sustainable Packaging Startups in India

Here, people can start investment at just Rs 500, some of its best features are impressive returns, no hidden charges, and monthly interest payouts.

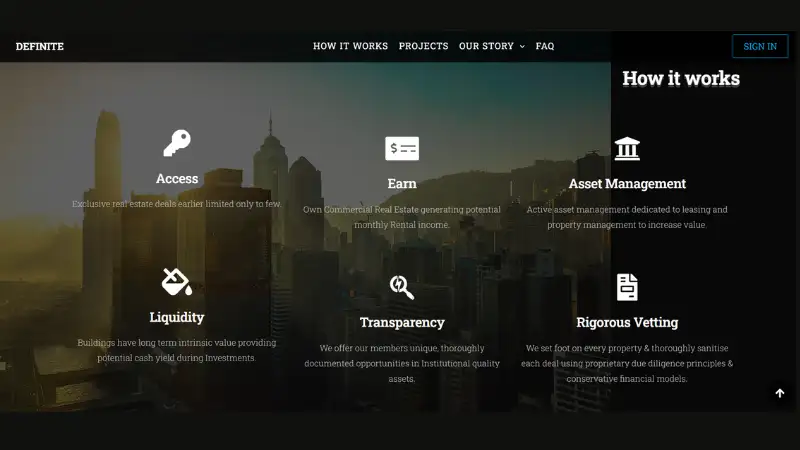

4. Definite

Definite is a high-tech platform that provides easy access, asset management, and transparency. It focuses on selected rent-producing commercial real estate assets.

Read also – Top 10 EV Financing Companies in India

Users can easily invest low-cost portfolio of top-notch real estate that uses technology. Investors can easily build diverse real estate portfolios, in multiple types of properties in various places.

5. GripInvest

GripInvest transforms the concept of wealth with its alternative investment platform, providing monthly returns of up to 16%. As a SEBI-regulated platform, your investments are secure.

Read also – Top 10 EV Charging Startups in India

The best part is anyone can easily start investing at just Rs. 1,000. It prioritizes diversification, diversification, non-market-linked assets, great returns, and selected investment opportunities.

6. Tradecred

It is the best alternative platform in India, it is the only investing platform that accepts invoice discounting as a type of investment. Invoice discounting serves as a fundraising method employed by businesses.

Read also – Top 20 Best Electric Vehicles (EV) Startups in India in 2024

They get a little small amount of money from normal investors. It gives investment opportunities for people like you and me.

7. Lendbox

Lendbox is one of the licensed P2P lending platforms in India which RBI approves. It was started in 2017 and currently, it is one of India’s best P2P lending services. Recently, it went through an update, introducing for users.

Read also – Top 10 Best YouTube Channels for Startup Founders

To provide investors with low-risk investment possibilities, it has collaborated with some renowned institutions. These companies act as guarantors for the loans which is taken by their channel members and merchants. It ensures annualized return of 12% to 20%.

8. Strata

Strata is an Indian crowdfunding platform specially designed for real estate. With the help of strata, Real estate developers have the opportunity to directly secure funds from investors, It is an online community that enables equity investments in real estate, with the investment starting at $2.50 million.

Read also – Top 10 ERP Systems for Startups

Some of the partners in strata are Gemba Capital, Kotak Investment Advisers, Mayfield India, Elevation (SAIF Partners), Gruhas Proptech, and more.

9. AltiFi

AltiFi is a cutting-edge financial platform, where that helps individual users purchase fixed-income assets. This includes Securities which previously accessible to investment companies, retail investors, rich people, and HNIs.

Read also – Top 10 Popular Travel Management Software For 2024

It facilitates rich individuals, big institutions, and regular investors to deposit certificates and buy bonds from growing businesses in a variety of industries.

10. Jiraaf

Jiraaf is a Fintech platform in India that allows small-scale investors to explore alternative investment options in India. It is known as one of the best alternative investment platforms in the country.

Read also – Top 10 Email Management Tools

As per as company, they provide higher returns as compared to fixed deposits. In their investment, they have little risk, and the potential rewards are generally favorable.

Conclusion

Alternative investments are one of the best ways to diversify your portfolio. Several alternative investment platforms offer passive income. Apart from this, you can use it for retirement as well as for bills. In India, members of investment alternatives are not market-linked.

Frequently Asked Questions (FAQs)

What are Alternative Investment Platforms?

It is an online platform that helps people in invest non-traditional assets such as real estate, private equality, and startups.

What is the minimum amount we invest in the Alternative platform?

It depends on the type of investment, some provide liquidity options while some have a fixed investment period.

Which are the Top 10 Alternative Investment Platforms in India?

Tradecred, Lendbox, 13Karat, Strata, AltiFi, GripInvest, Definite, 13Karat, Tyke, and Faircent are the Top 10 Alternative Investment Platforms in India.