Credilio, founded with the idea of digitising distribution value chain of personal finance products, announced that it has raised USD 4 million (INR 30 Crores) in a pre-series A funding round with a clutch of investors that include Cornerstone Venture Partners Fund (CSVP Fund), Exfinity Venture Partners and Param Capital founder Mukul Agarwal in his personal capacity.

The capital raised will power Credilio’sambitious plans to meet an ARR of 100Cr by March 2023 and serve 25 million customers in the next 3 years.

The fresh round of funds will be deployed towards strengthening Credilio’s lending product penetration by enhancing technology capabilities and harnessing the potential of evolving API stacks of Banks / NBFCs. The capital will also be directed to kickstart the implementation of sophisticated analytical tools and credit bureau information to accurately find the best-suited product portfolio that meets the consumers’ requirements.

The start-up also plans to scale its presence with a stronger focus on tier 2-3 cities and introducing platform access in 7 regional languages. The start-up has been committed to also upskill financial advisors to make them digitally equipped to serve their customers in a sharper environment and transform their experience of investing in personal finance products.

Speaking on the fundraise, Aditya Gupta, Co-Founder, and CEO, Credilio, said, “We are extremely delighted to have found the right partners to back our ambitions at this juncture of our growth journey. India currently has over 6 million individuals engaged in selling financial products such as loans, cards, insurance, and investment products manually. The traditional personal finance (Credit cards & Loans) market is largely dependent on intermediaries and riddled with manual processes and that’s the challenge Credilio aims to solve by creating India’s first advisor-led technology platform for distribution of personal finance products. With this raise, we aim to not only strengthen our core offerings but also scale the platform to expand our footprint effectively deeper into the country. Our investors bring together a perfect blend of experience in backing early stage companies that can go on to become listed enterprises. Our target is to onboard 1 million Financial Advisorsfor loans and cards over the next 24 months.”

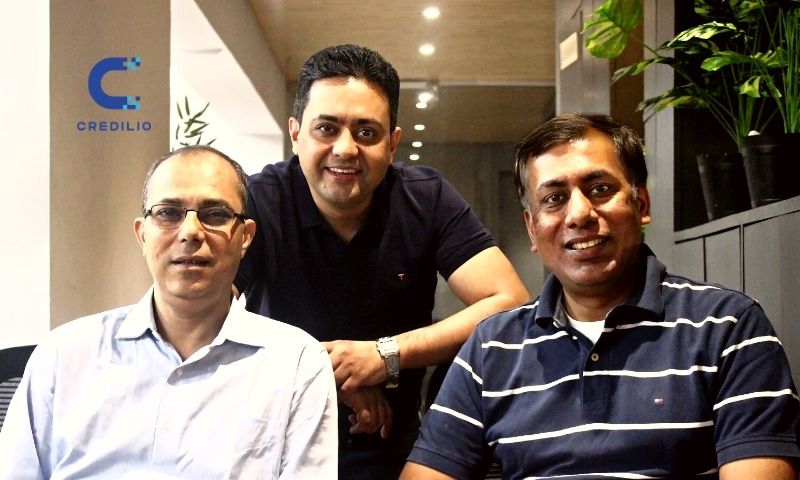

A pioneering start-up in its space, Credilio is the brainchild of second-time entrepreneurial trio Aditya Gupta, Sandeep Ghule, and Anand Kapadia. Their first venture TranServ solved for digital payments in the B2B segment, leading to a successful exit in March 2019 with Indiabulls Consumer Finance acquiring the start-up.

Credilio helps any Financial Advisor educate customers and recommend products that are best suited to meet their personal credit requirements, and also facilitate digital onboarding of credit cards & loans seamlessly. The company has created digital rails for distribution of personal finance products by leveraging open Banking APIs of leading Banks & NBFCs. It provides a simple mobile app and a customized recommendation tool that empowers financial advisors to be truly digital and future-ready.

In just under a year, Credilio has over 10,000 active Financial Advisors pan-India and 5+ lakh customer applications processed digitally for 20+ leading Banks & NBFCs such as HDFC Bank, ICICI Bank, Axis Bank, IDFC First Bank, SBI Cards, Citibank, Standard Chartered, Bajaj Finance, Tata Capitaland others.

Adding on, Nihar Ranjan from Exfinity Venture Partners, said, “Credilio’suniquegrassroot forward approach is a winning strategy, as it brings together Lenders, Intermediaries and Customers on one seamless platform to revamp the industry with new paradigms of transparency, speed and efficiency.”

This latest fund raise announcement follows closely on the heels of the start-up’s achievement of hitting a remarkable growth of a $ 1 million mark in ARR within six months of being operational. The start-up had raised a seed fund round from angle investors in June 2021 and launched operations shortly after.

Built with the aim of enhancing value for customers and empowering traditional advisors to go digital, the platform will play an important role in bridging the existing gaps in the customer acquisition and approval processes in the personal finance industry. The platform will also provide Banks and NBFCs with a ready digital distribution network across India.

On the funding, Vatsal Bavishi, Investment Director, Cornerstone Venture Partners, said, “Credilio fits perfectly with our investment thesis of Enterprise & SMB SaaS for India. I see Credilio’s potential to grow exponentially with their product-firstapproach and agile thinking. The strong founder team and a robust go-to-market strategy makes them a winning bet as we look toward innovation in the fintech industry. We are particularly excited about the unmatched reach the platform creates for traditional ‘offline’ distribution channels to seamlessly go digital and benefit from access to numerous products and efficiencies of the platform –taking this to the smallest towns& cities in India!”

Param Capital founder, Mukul Agarwal, said, “With Credilio’s diverse and promising partner portfolios and its plan to expand to the heartland of India, I see them playing a critical role in dynamically shifting the gears for fintech innovation in India in order to make it inclusive and progressive.”

About Credilio

Credilio set out to do one thing – simplify the world of personal finance distribution! Founded in 2020 by Aditya Gupta and Anand Kapadia, Credilio marks the second entrepreneurial stint for this maverick team that set up Transerv, a leading digital payments company in India that went on to get acquired by IndiaBulls Consumer Finance Group in March 2019. The mission of Credilio – to create a nationwide army of multi-branded trained advisors who can assist in digital onboarding of loans and cards.

Credilio enables a small financial advisor to educate customers and recommend lending products that are best suited to meet their unique requirements and further enabling them to subscribe for credit cards or loans digitally. The company does this by providing a large range of product offerings and a customized recommendation tool through a simple mobile app that empowers advisors to be truly digital and future-ready.

In addition, the platform allows for instant online approval by leveraging open banking APIs of Banks and NBFCs, thus making the purchase process transparent and paperless. It has reduced the average prospecting-to-onboarding time to less than 10 minutes in a single session as compared to industry average of an interrupted process over 2-3 days.