It is a smart plan to have a financial adviser who can take care of your money, especially because it is important for those who don’t have much time or don’t understand the functions and workings of the stock market.

This is where a mutual fund investing corporation or an Asset Management Company (AMC), comes to help. They also help their clients by suggesting money in a variety of asset classes.

Read also – Top 10 Online Financial Planners and Advisors Startups in India

Asset Management is an organization or company that takes money from its clients and invests it in various ways to make it grow. They invest in other companies, operations, or somewhere else. Their main aim is to grow the value of investment. Here, we will see the top 10 Asset Management Startups in India.

10 Best Asset Management Startups in India

Here is the list of the Top 10 Asset Management Startups in India

1. KredX

KredX is a platform that offers an online invoice discounting marketplace for both Small and Medium Enterprises (SMEs). It helps businesses to get quick access to the money they own. It helps its users in investments where they can earn low-risk, high returns through a short-term, low-risk investment.

Read also – Top 10 Insurance Broking Companies in India

KredX is a Bengaluru-based platform founded by Manish Kumar in 2015 and backed by multiple investors such as Prime Venture Partners, Sequoia Capital India, Tiger Global Management, and many more.

2. Sqrrl

Sqrrl is an investment platform where they help their customers in investment. It helps users to invest in high-performing (zero-commission) mutual funds without paying any commissions. Customers can choose funds based on their investment needs, risk horizons as well and goals. Their Application is available on both platforms Android and iOS.

Read also – Top 10 Profitable Unicorn Startups in India in 2024

Headquartered in Gurgaon, Sqrrl was founded in 2016 by Dhananjay Singh and Sanjeev Sharma and backed by Equanimity Investments.

3. Smallcase

Smallcase is a platform where they provide their customers with the best option for investing or creating portfolios of stocks or exchange-traded funds based on specific themes. Smallcase introduced some of its initial themes such as GST, affordable housing, and digital India.

Smallcase was founded by Vasanth Kamath, Anugrah Shrivastava, and Rohan Gupta, headquartered in Bangalore. It is supported by multiple investors such as BEENEXT, Sequoia Capital, WEH Ventures, and many more.

4. Piggy

Piggy is an intelligent money app with an in-built bank account that helps its customers save and invest automatically. It offers the best way to make mutual fund investments in the country.

Read also – Top 10 AI Investors For Startups in India

It offers multiple types of funds to its customers such as Tax funds, Balanced funds, Debt funds, Equity funds, and many more. Headquartered in Mumbai it was founded by Ankush Singh, Nikhil Mantha, and Kunal Sangwan.

5. ET Money

ET Money is one of the biggest apps for financial services in India and it makes the financial journey of millions of Indian investors.

It has more than $3 billion worth of assets under management. Where it has over 10 million users across 1400 cities. ET Money is a Gurugram-based platform that was founded in 2015 by Mukesh P Kalra.

6. Groww

Groww is an investing platform, where users can find the best mutual funds and seamlessly invest their money. It is a part of NextBillion Technology, where it emerges as a promising fintech firm aimed at consumer finance management.

Users can easily login through the web or app and manage their finances. It is a Bangalore-based startup founded in 2016.

7. ZFunds

ZFunds is a platform established in 2019, that provides financial-related Services. Here, Users can discuss with Financial Experts and Financial Advisors so they can use their money in the right place.

Headquartered in Gurugram, it was founded by Manish Kothari, Yogesh, and Vidhi Tuteja.

8. AiREM

AiREM is a Delhi-based platform that stands as the Global platform where they offer end-to-end Real estate AIoT Sustainable and comprehensive Real Estate Asset Management Services.

It takes care of everything from managing buildings to handling properties and assets. It provides all solutions at a single platform related to real estate management.

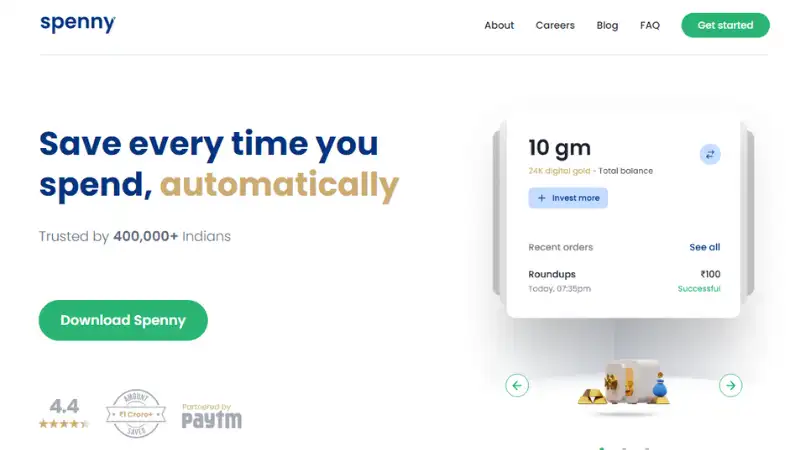

9. Spenny

Spenny is a micro saving and investment app that creates portfolios for users by gathering the leftover change from daily transactions.

Whenever customers make a transaction, it rounds the amount to the nearest 10, 20, 50, or 100 INR and automatically invests it into a “managed diversified portfolio”.

10. Mynd

Mynd Integrated Solutions plays a crucial role as a global Business Process Management service provider, offering outstanding services in business process and technology management. The platform specializes in four major business verticals: Finance and Accounting (FAO), Human Resource Outsourcing (HRO), and Consulting.

Conclusion

Asset management startups are growing day by day, they come with new and easy ways to help their customers. It helps people and businesses to handle their money. These Startups use technology to provide the best and simplest way to invest or manage their money. With the use of AI and IoT, these startups are growing day by day.

Frequently Asked Questions (FAQs)

What are Asset Management Startups?

It is an organization that invests or manages its assets on behalf of its clients.

Who founded Spenny?

Spenny was founded by Gaurav Arora and Rathin Shah.

Which are the Top 10 Asset Management Startups in India?

KredX, Sqrrl, Smallcase, Piggy, ET Money, Groww, ZFunds, AiREM, Spenny, and Mynd are the Top 10 Asset Management Startups in India.